SMGR

Contact our analyst Eka

Hold

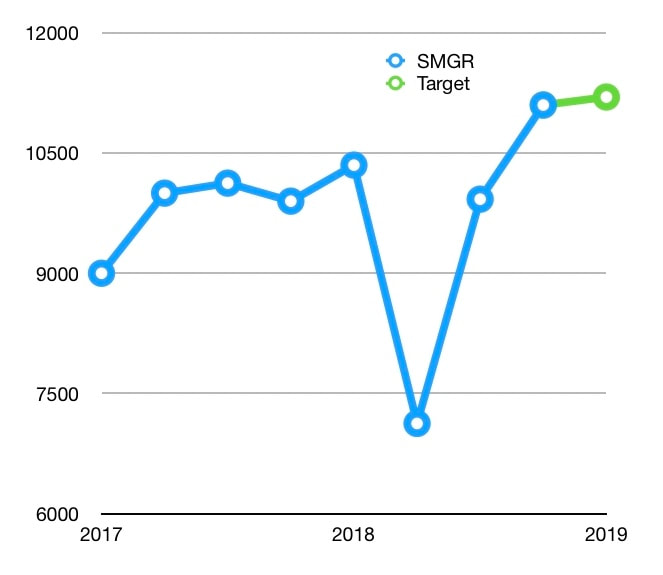

Price Rp 13,175

Target price Rp14,800

Price Rp 13,175

Target price Rp14,800

2018FY higher margins

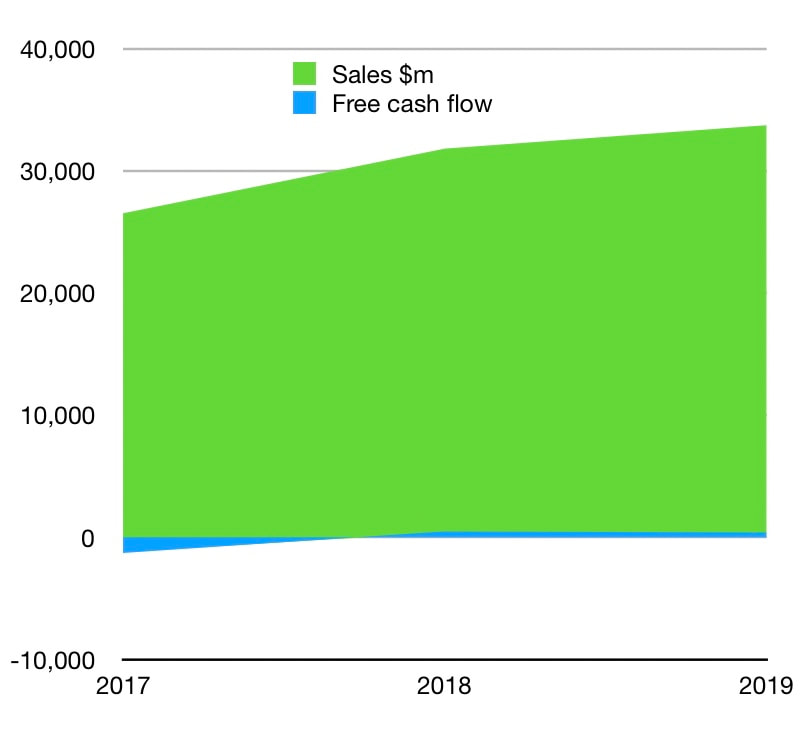

- In 2018FY, SMGR revenue increased 10.3% yoy to reach IDR 30.7 trillion inline with a 5.6% increase in sales volume.

- COGS grew 7.6% but lower than revenue growth because of the following cost initiatives: 1). centralizing coal procurement at the holding level to gain better pricing. 2). rerouting the distribution network to ensure margin optimization and lower costs. 3) reducing clinker costs. 3) operating the new WHRPG plant in Tuban. As a result, SMGR enjoyed a gross profit increase of 17.2% yoy to IDR 9.33 trillion from IDR 7.96 trillion in 2017.

- Although transportation expenses increased in the 4Q as the new ODOL ( Overdimension & Overloading) policy has been applied since August 2018, overall operating expenses decreased by -12.9% yoy to IDR 4.45 trillion as selling expenses decreased by -7.2% and general and administration expenses decreased by -20.4%.

- The EBITDA margin increased by 3.8% yoy to 21.4%. Net income increased by 89.9% yoy.

Sign up now to trade; what you want, when you want, where you want.

Solusi Bangun Indonesia (SBI), (ex-Holcim) Acquisition

- After the acquisition of Holcim (now called PT Solusi Bangun Indonesia 'SBI'), SMGR has a total installed capacity of 50.7 mt and becomes one of the 15 largest cement companies in the world.

- The acquisition of SBI was at an implied EV/Capacity of USD 117/tonne, which is lower than the estimated greenfield investment cost for new plants in Indonesia of USD150-180/tonne and lafarge Holcim divestment in Asia of USD 130 - 177 / tonne.

- SBI will consolidate with SMGR starting from the 1Q2019 financial results.

- In the first quarter of 2019, SMGR sales volume including Thang Long Cement in Vietnam and SBI reached 8.89 million tons (mt) an increase of +19.24% yoy from 1Q2018 (SBI not included). While Industry domestic sales volume was 15.7 mt, relatively flat YoY growth of -0.4%. SMGR’s domestic volume decreased by -3.48% YoY to 5.98 mt.

- The lower growth in domestic sales is due to the rainy season and upcoming general election which both dampened cement demand in 1Q2019.

- We expect an improvement in cement demand in the second semester of 2019 after the election and Lebaran.

- Assuming cement demand will increases in the second semester of 2019, We are targeting SMGR share price to reach IDR 14,800 which is a valuation of 28.6x PE.

- Using a DCF valuation with WACC at 9.5%, we estimate SMGR shares will rise by 12.3% within a year. We recommend to HOLD.

Previously