SMGR

Contact our analyst Eka

Maintaining costs as oversupply continues. BUY

9th May 2018

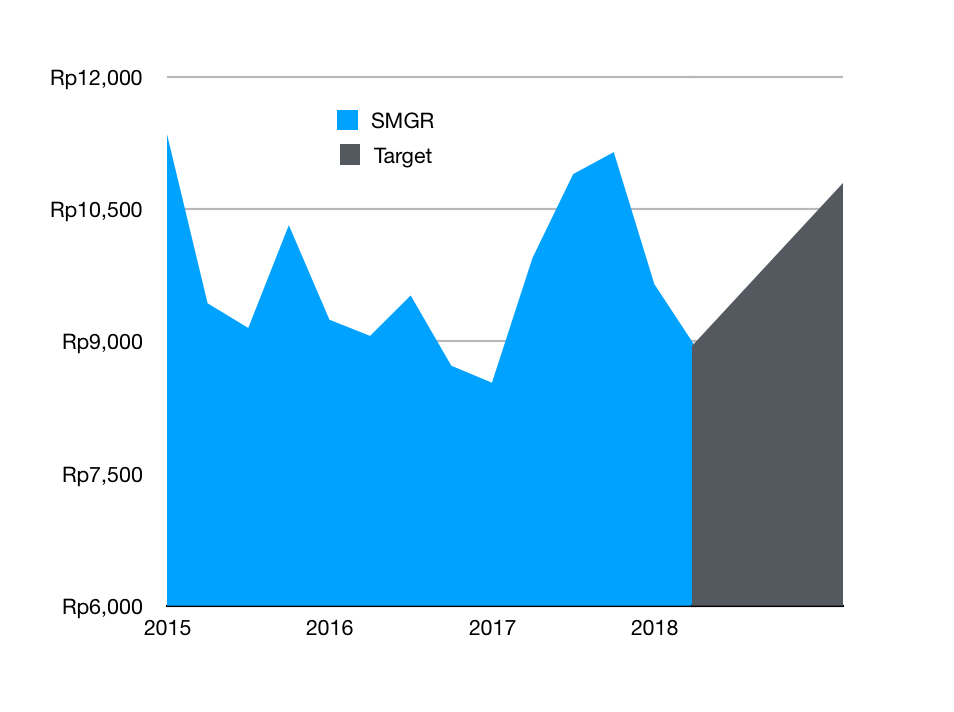

Price Rp8,950

Target price Rp10,800

9th May 2018

Price Rp8,950

Target price Rp10,800

1Q2018 Results

Efficiency is key

Valuation: TP 10,800 with 20% upside

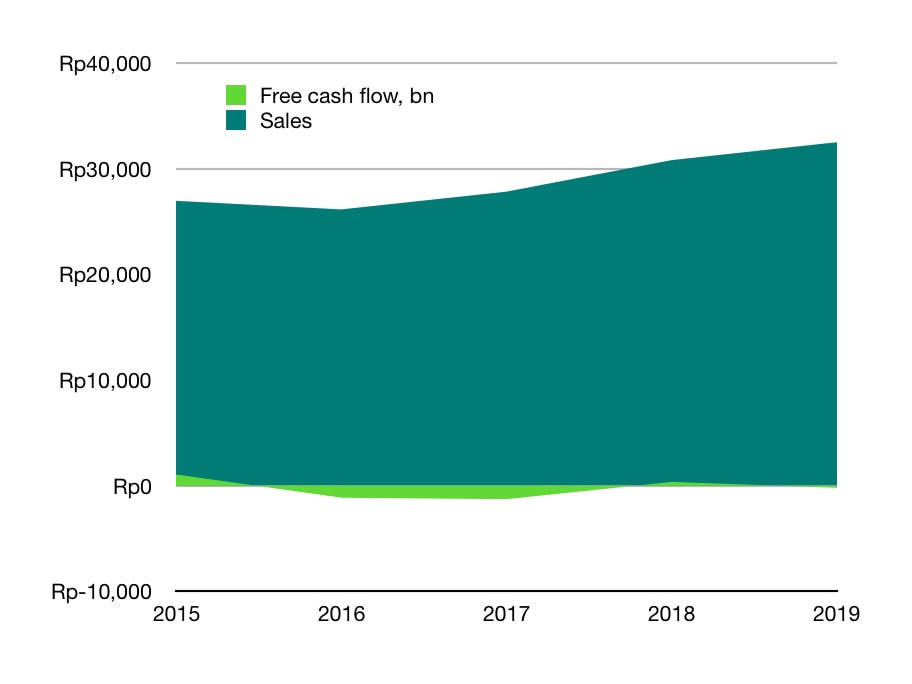

- 1Q2018 sales volume reached 7.4 million tons +2.9% yoy. Revenue increased +3.4% to IDR 6.62 trillion, cost of revenue increased +10% to IDR 4.9 trillion from increase in coal prices 18.5% higher in 1Q2018 vs 1Q2017.

- Net income -44.9% to IDR 411.5 billion. Other than coal prices, increased interest expenses also caused decrease in net income related to commercialization of the Rembang and Indarung plants, where the project interest costs were previously capitalized.

Efficiency is key

- SMGR business strategies for 2018. Centralized marketing, Supply chain optimization, Centralized procurement, Cost transformation, & growth.

- Maintain cost by buying coal at lower prices and reducing coal use, purchasing spare parts by buying as a group, & reducing electricity cost by operating a Waste Heat Recovery Power Generator with capacity 30.6 MW in 2018.

- To improve distribution, SMGR is completing two packing plant projects in Maluku and Bengkulu in 2Q 2018.

Valuation: TP 10,800 with 20% upside

- We estimate oversupply situation & tight competition will still exist in cement domestic market in 2018.

- Using a DCF valuation with WACC at 8.80%, we estimate SMGR shares will rise by 20% to IDR 10,800 within a year.

- We recommend BUY.