SMGR

Contact our analyst Eka

34% profit growth, BUY

6th November 2018

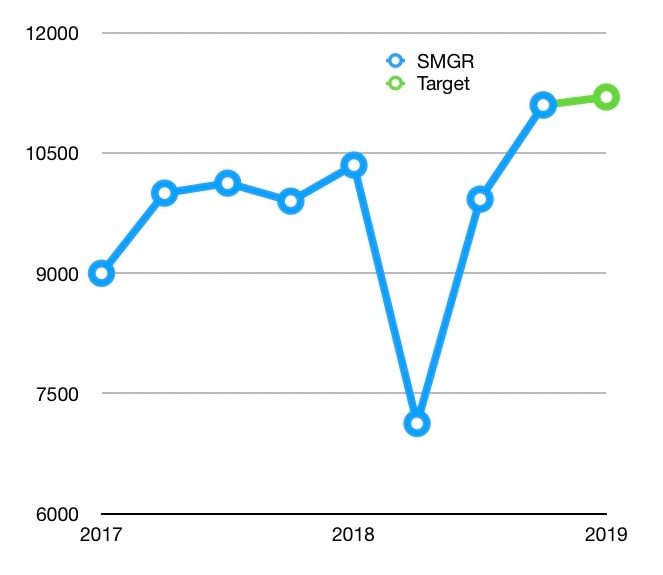

Price Rp 9,600

Target price Rp11,200

6th November 2018

Price Rp 9,600

Target price Rp11,200

Expecting 34% growth in profit

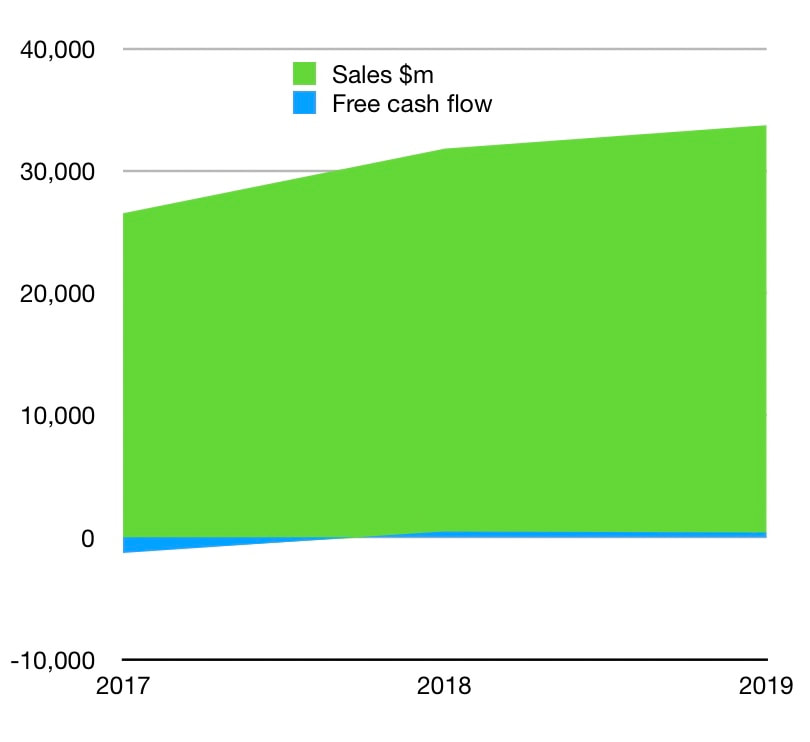

- SMGR’s revenue increased +4.4% to IDR 21.45 trillion in line with sales volume growth. While cost of revenue also increased +3.9% to IDR 15.1 trillion inline with the increase in sales volume and mainly from fuel, raw material, and distribution costs.

- Efficiency and restructuring in SMGR’s logistic supply resulted in lower operating expenses (opex) in 9M2018 by -9.8% YoY to IDR 3.7 trillion from 4.1 trillion. The impact comes from: 1) decrease in transportation expenses by -16.6%. 2) promotion expenses decreased by -19% YoY. 3) Salary expenses decreased by -12%YoY, and 4) Business trip expenses decreased by -13% YOY.

- So SMGR booked an operating profit increase of +36% YoY to IDR 2.6 trillion. And the bottom line increased 43% to IDR 2.1 trillion.

- We assume the lower opex will continue until the end of year. And we expecting bottom line to increase 34% in 2018F to IDR 2.7 trillion from 2 trillion last year.

Sign up now to trade; what you want, when you want, where you want.

Stable Sales Volume

Valuation: TP 11,200 with 17% upside

- SMGR sales volume including Thang Long Cement in Vietnam reached 23.8 million tons (mt) an increase of +4.9% yoy in 9M2018. Industry domestic sales volume was 49.76 million tons (mt), or stable (+4.9%) compared to 9M2018. SMGR’s domestic volume only increased by 1.2% YoY.

- The lower growth in domestic sales is due to SMGR’s decision to increase selling prices since November 2017.

- We expect an improvement in cement demand from a pickup in infrastructure development in the last quarter of 2018. In addition, the latest mortgage policy is expected to boost the property market and help a recovery in cement demand.

Valuation: TP 11,200 with 17% upside

- Assuming lower opex in 2018 and improving cement demand in 4Q2018, We are targeting SMGR share price to reach IDR 11,200 with 24.6x PE.

- Using a DCF valuation with WACC at 9.6%, we estimate SMGR shares will rise by 17% within a year. As the price already increase in October (+22%), we recommend to HOLD.

Previously

| smgr_6_november_2018.pdf |

| smgr_9_may_2018.pdf |