PGAS

Contact our analyst Eka

Post Merger Result

February 2019

Price Rp2,610

Target price Rp2,960

February 2019

Price Rp2,610

Target price Rp2,960

Strong 2018FY Results post acquisition

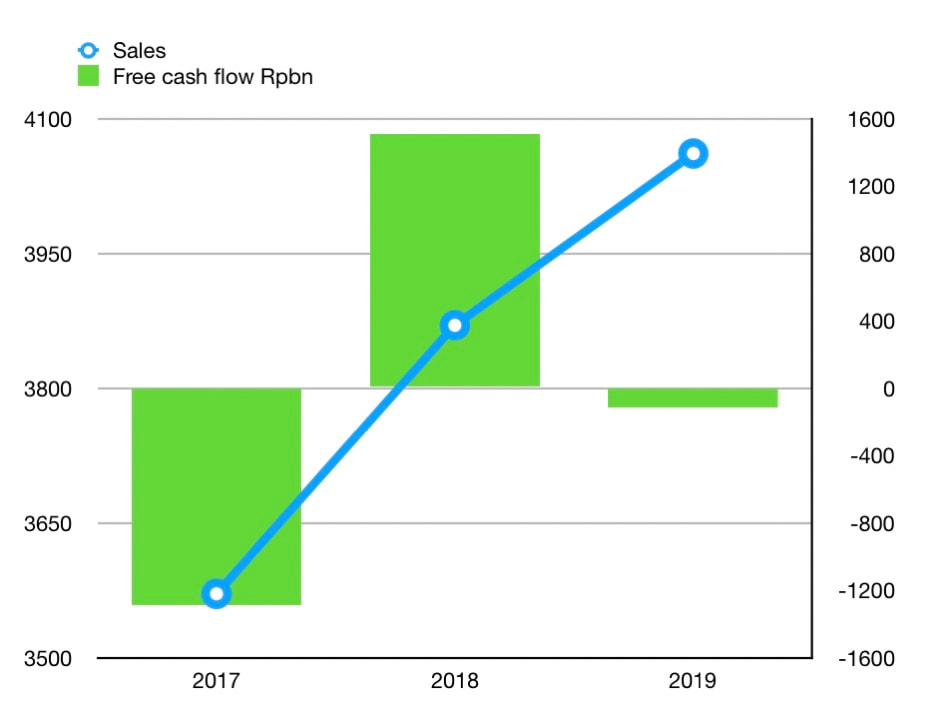

- •In 2018, PGAS's consolidated revenue reached USD 3.87 billion, +8.4% yoy (as restated)

- Gross profit reached USD 1.3 billion +11% yoy compared to 2017 USD 1.18 million.

- EBITDA margin increased to 31.0% from 30.3%.

- Net Income grew +55.3% to USD 305 million, from USD 198 million in 2017.

- PGAS is now the holding company for the integrated gas (midstream and downstream) business.

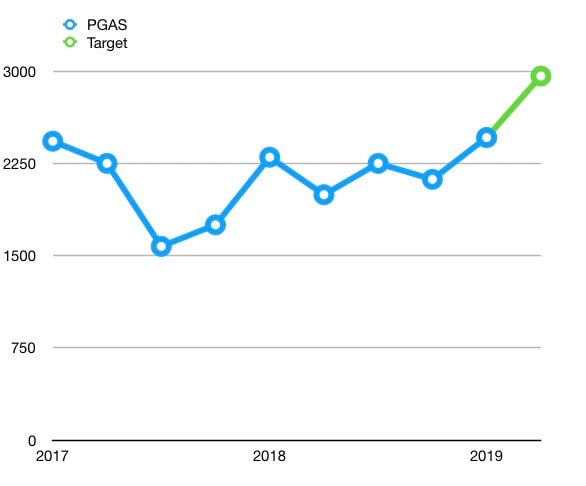

- PGAS’s distribution volume reached new heights in 2018 at 967 MMScfd +8% yoy from 898 MMScfd in 2017.

- For 2019, PGAS is targeting volume at 900 – 950 MMScfd, unchanged from 2018.

- In Transmission, volume reached 2,101 MMscfd, +1% yoy.

- We expect PGAS revenue in 2019F to reach USD 4.06 billion or +5% yoy.

- HOLD with TP 2,960 with 13.4% Upside

- A DCF valuation with WACC at 8.35%, gives a revised target price of IDR 2,960 or 13.4% upside which is a 15.4x PE valuation within one year. HOLD