PGAS

Contact our analyst Eka

Post Merger Valuation

9 July 2018

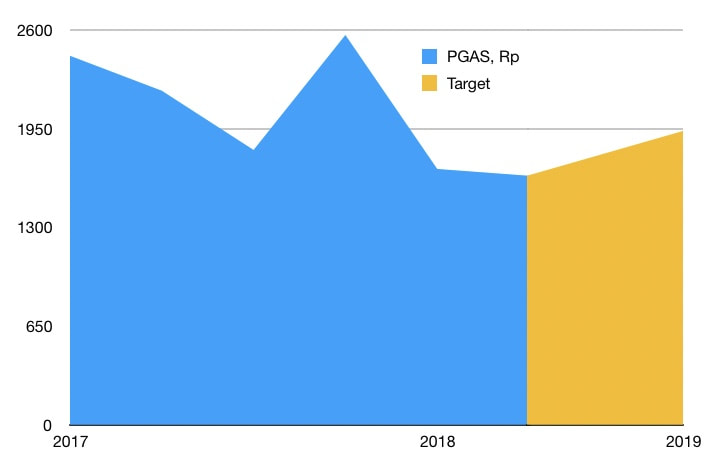

Price Rp1,565

Target price Rp1,935

9 July 2018

Price Rp1,565

Target price Rp1,935

PERTAGAS acquisition

- PGAS has acquired 51% of PT Pertamina Gas (PTG) from PT Pertamina (Persero) for IDR 16.6 trillion, which implies IDR 32.6 trillion for 100%.

- The fair valuation of Pertagas includes PT Pertamina Gas valued at IDR 28.4 trillion and PT Pertagas Niaga valued at IDR 4.2 trillion as of December 2017. The valuation methods used are DCF and Market Comparables. The funding will come from internal cash 30% and 70% from bank loans.

- Post Acquisition, PGAS’s total gas pipeline network will be 9,677Km covering 14 provinces and 55 regencies, 2 FSRUs, 12 gas fueling stations, 4 MRUs, total transmission and distribution volumes of 3 Bcfd with 96% market share in transmission and distribution of gas.

- PGAS is targeting distribution volume growth of 7% per annum, transmission volume growth of 5% per annum. PGAS plans to have an additional 576 km network of pipeline.

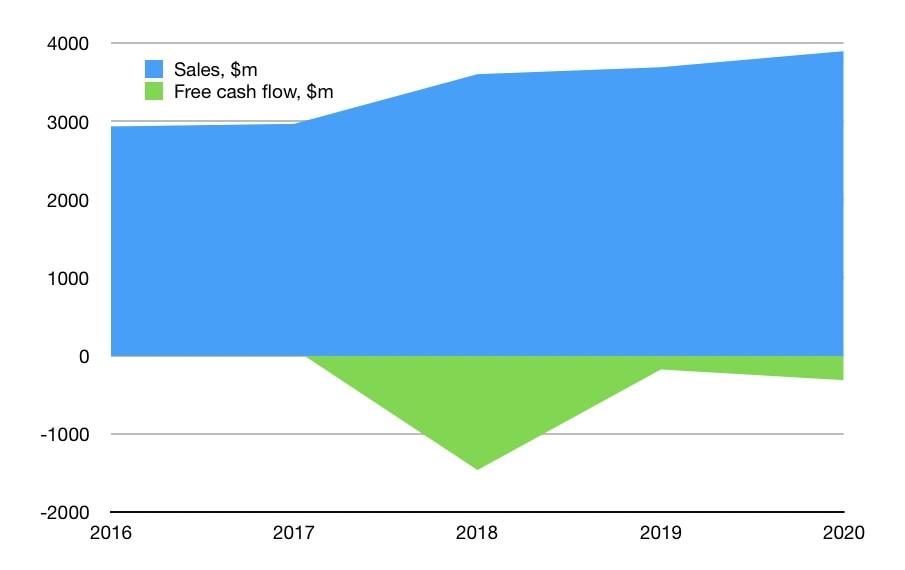

- PGAS targets to earn an additional EBITDA of USD 65 million a year on average for the next 5 years.

- PGAS near term business integration plan post acquisition includes 1) eliminating operational duplication, particularly in East and West Java. 2) Market expansion of the distribution business in Medan, Dumai, Central Java, East, and West Java. 3) Market expansions of the transmission business in Semarang - Cirebon. 4) Market expansion of the LNG business in Papua & surrounding areas. and 5) Retailing of CNG and LNG. For Upstream business, PGAS is still in discussions on SAKA Energy’s future.

- We are targeting revenue to reach USD 3.6 billion in 2018F & grow 21% after the acquisition.

- A DCF valuation with WACC at 4.07%, gives a revised target price of IDR 1,935 or 24% upside and a 13x PE valuation within a year. Maintain BUY