JPFA

Contact our analyst Eka

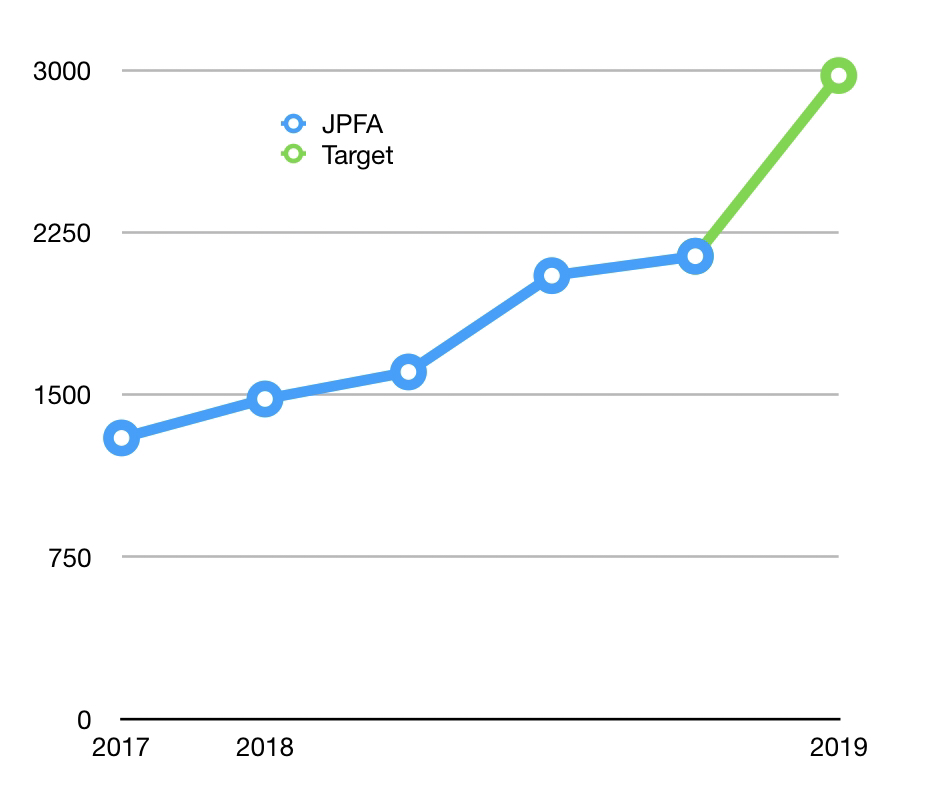

Maintain Buy, 25% upside.

14th March 2019

Price Rp 2400

Target price Rp 3000

14th March 2019

Price Rp 2400

Target price Rp 3000

2018FY Results: Triple digit growth

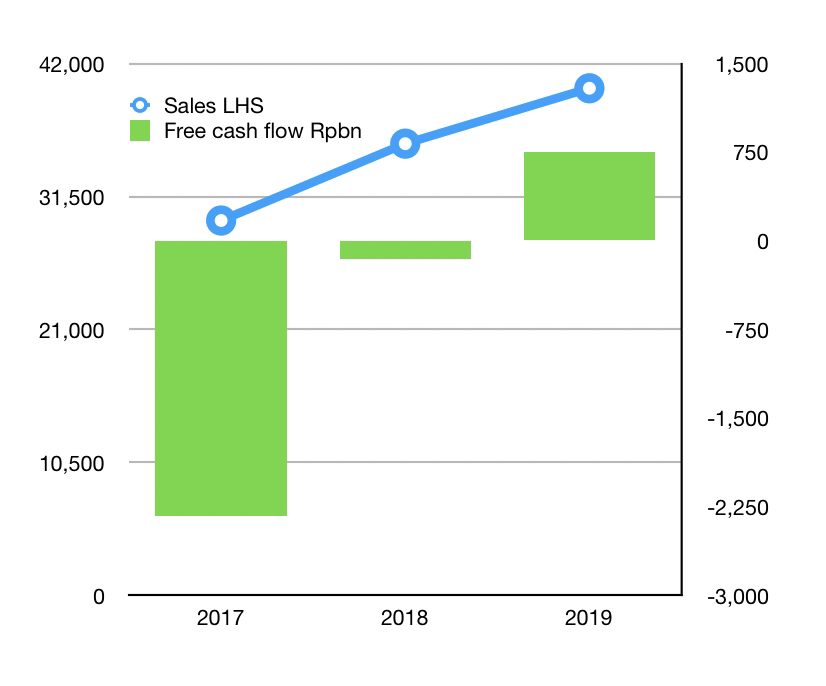

- JPFA booked revenue of IDR 34.01 trillion up 14.9% yoy from IDR 29.6 trillion in 2017, slightly lower -4.6% compared to our revenue estimate at IDR 35.6 trillion. Growth was mainly from higher sales volumes for poultry feed and DOC as well as higher ASPs across the poultry business.

- JPFA operating margin grew from 7.5% in 2017FY to 11.3% in 2018FY, slightly lower compared to our estimated at 12.2% in 2018. Breeding operating margin was the highest in 2018FY at 22.6% up from 2017FY’s 12.0%. The high operating margin in 2018FY was mainly due to high ASPs for DOC and broiler driven by lack of DOC supply.

- Profit for the year grew 116% to IDR 2.25 trillion. This is slightly lower than our estimate of IDR 2.043 trillion.

- JPFA 2018FY results show profitability lifted by higher poultry ASPs and breeding productivity.

- The poultry feed business continued to be the key profitability pillar with a growth in sales volumes of approximately 6%. Meanwhile breeding operations recorded exceptionally strong profits in 2018FY with higher DOC ASP due to lack of supply in Indonesia.

Trade what you want (exciting shares like JPFA) when you want & wherever you are. Simply sign up for our Binaartha Online Trading

⬇️ here.⬇️

⬇️ here.⬇️

Conservative 2019 forecasts

Valuation: Maintain BUY TP 3,000, 25% upside

- We are targeting double digit growth for JPFA’s revenue with +26% growth to IDR 42.7 trillion in 2019F as we expect higher sales volume growth and higher poultry ASPs.

- But we are more conservative for JPFA 2019F bottom line as higher corn prices, and fluctuations in SBM prices, will impact to higher COGS. We estimate JPFA 2019F GPM & OPM will reach 18% and 9.5% respectively.

Valuation: Maintain BUY TP 3,000, 25% upside

- We maintain a BUY for JPFA on the strong result in 2018FY with higher volume of DOC and livestock and higher poultry ASPs that will boost 2019 results.

- Using DCF valuation with WACC at 8.41% We are targeting JPFA to trade at 15x 2019F PE within a year. Target Price is IDR 3,000 which represents 25% upside. BUY

Previously