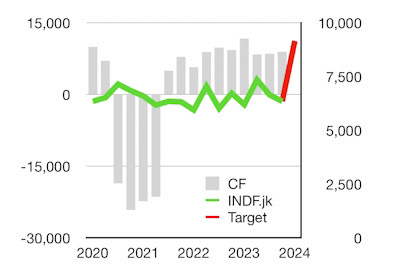

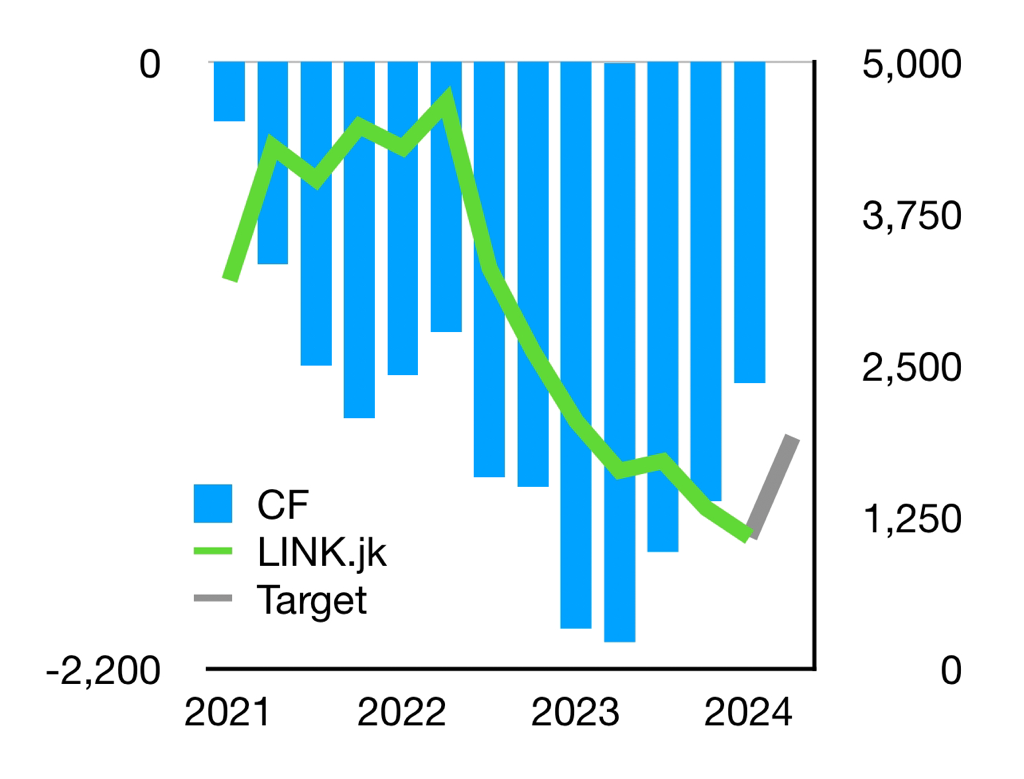

JPFA

Contact our analyst Eka

Expecting Triple digit growth, 42% upside.

15th November 2018

Price Rp 2090

Target price Rp 2975

15th November 2018

Price Rp 2090

Target price Rp 2975

DOC productivity increased

- The ban on AGP this year is still causing lower productivity of DOC and higher prices of DOC.

- However JPFA recorded high productivity in their Breeding operations and were able to produce more DOCs. DOC volume recorded growth of +12.5% YoY in 9M2018. Meanwhile JPFA’s DOC average selling price in 9M2018 grew +21% YoY.

- The higher productivity in breeding operating resulted in higher demand of feed volume which grew +7% YoY in 9M2018.

- We expect the higher price of DOC will continue until the end of year.

Trade what you want (exciting shares like JPFA) when you want & wherever you are. Simply sign up for our Binaartha Online Trading

⬇️ here.⬇️

⬇️ here.⬇️

Expecting Triple Digit Growth in 2018F

- We are targeting triple digit growth for JPFA’s net profit with +144% growth to IDR 2.43 trillion in 2018F from IDR 998 million in 2017 based on the good 9M2018 results.

- As of 9M2018, JPFA sales grew +17% to IDR 25.3 trillion from IDR 21.7 trillion in 9M2017. The increases was mainly from higher ASPs, as DOC and live bird ASPs grew double digits at 21% and 15% respectively.

- Operating profit grew +81% to IDR 2.99 trillion from IDR 1.65 trillion in 9M2017 resulting in a net profit increase of +108% to IDR 1.67 trillion from IDR 802 billion.

- We maintain BUY for JPFA on the strong result in 9M2018 with higher ASPs of DOC and livestock that will boost 2018 results.

- Using DCF valuation with WACC at 8.44% We are targeting JPFA to trade at 14x 2019F PE within a year. Target Price is IDR 2,975 which represents 42% upside. BUY

Previously