INTP

Contact our analyst Eka

HOLD

26 March 2019

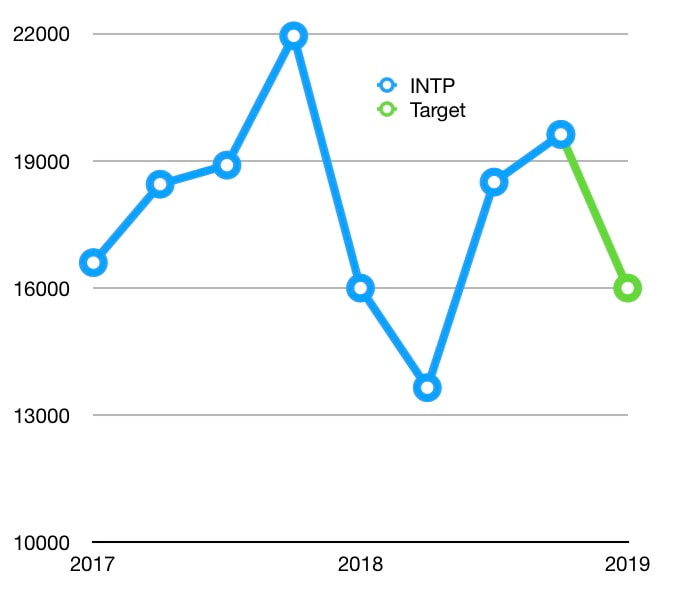

Price Rp 20,775

Target price Rp 21,400

26 March 2019

Price Rp 20,775

Target price Rp 21,400

2018FY Result: Better-then-expected

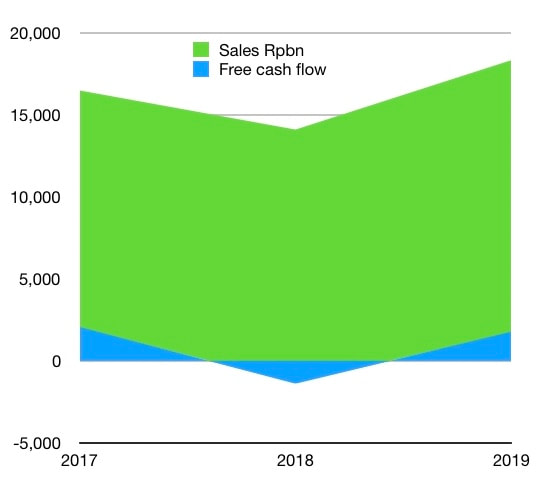

- INTP booked net revenue of IDR 16,92 trillion in 2018 +5.3% YoY. In line with growth in sales volume and a better ASP in 4Q2018. The achievement of 2018 was better-than our expectation of IDR 15.5 trillion.

- Cost of revenue increased +14.8% and depressed gross profit to IDR 4.37 trillion which is -12.7% YoY. Fuel and power costs were the biggest contributors at 45% of total cost of revenue and they increased +18% yoy in 2018.

- Operating expenses were slightly higher +5.2% YoY at IDR 3.3 trillion and so operating profit dropped -42.7% from IDR 1.87 trillion in 2017 to IDR 1.07 trillion in 2018.

- INTP booked a bottom line profit of IDR 1.15 trillion, which is a decrease of -38.4% YoY from IDR1.86 trillion in 2017. This is slightly higher than our expectation of IDR 1.14 trillion.

- For our 2019 forecasts, we expect INTP’s bottom line will improve from a better ASP and higher sales volume. We forecast INTP bottom line will increase by +11.4% YoY to IDR 1.28 trillion in 2019.

Sign up now to trade; what you want, when you want, where you want.

January – February Cement Sales Flat

- INTP sales volume growth in January-February 2019 was slower than Industry domestic sales volume. INTP total sales volume was 2.7 million tons (mt), or negative growth of -0.9% compared to 2017, while Industry domestic sales volume of 10.5 million tons was flat YoY.

- INTP market share slightly decreased from 26.2% to 26.0%.

- We expect single digit growth of cement sales and an increases of ASP in 2019 as we expecting no new cement capacity (oversupply getting better). This will help INTP utilization to reach 67% in 2020F from 63% in 2017 and 2018.

- Using a DCF valuation with WACC at 10.8%, we are targeting INTP to trade at 61.7x 2019F PE within a year.

- Target Price is IDR 21,400 which represents +3.0% upside. HOLD.

Previously