INTP

Contact our analyst Eka

We recommend sell.

6th November 2018

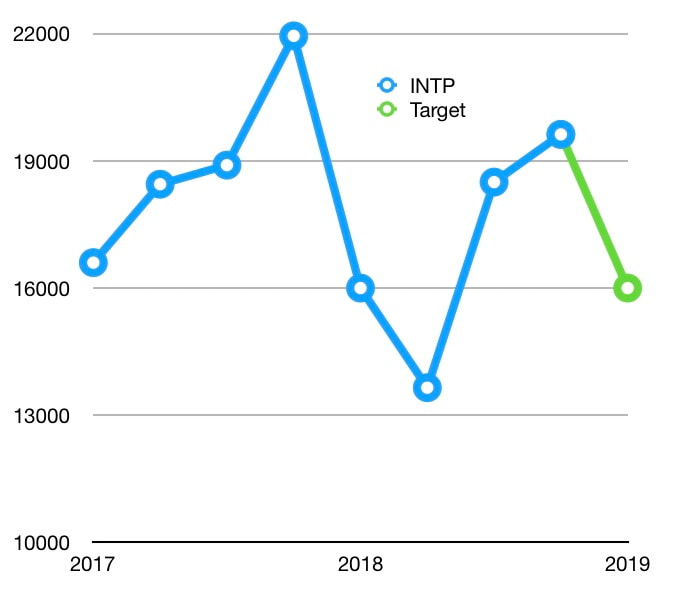

Price Rp 17,350

Target price Rp 16,000

6th November 2018

Price Rp 17,350

Target price Rp 16,000

9M2018 Result

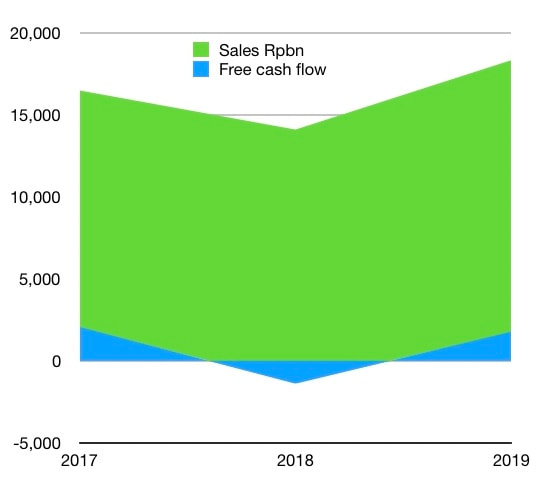

- INTP booked net revenue of IDR 10.77 trillion in 9M2018 +2.5% YoY.

- Cost of revenue grew +14.6%, and depressed gross profit to IDR 2.87 trillion which decreased -20.6% YoY. The Increases in cost of revenue is mainly due to higher fuel and power costs (+18.6%) and higher raw materials costs (+9.7%).

- Operating expenses were higher +9% YoY at IDR 2.38 trillion on an increase in delivery, loading and transportation expenses (+14% YoY).

- Higher operating expenses decreased operating income -64% from IDR 1.46 trillion to IDR 527 billion.

- INTP booked a bottom line profit of IDR 618 billion, which is a decrease of -56% YoY from IDR 1.4 trillion in 9M2017.

- After the 9M2018 earnings results we expect INTP’s bottom line will still be affected by higher energy costs and higher opex in 2018F, and forecast INTP bottom line will decrease by -38.4% YoY to IDR 1.1 trillion.

Sign up now to trade; what you want, when you want, where you want.

Better than Industry in 9M2018

Valuation: Maintain SELL with TP 16,000

- INTP sales volume growth in 9M2018 was higher than Industry domestic sales volume which at 49.76 million tons (mt), grew +4.9% compared to 9M2018. INTP total sales volume grew in 9M2018 by +6.6% to 13.8 million tons (mt) while domestic sales volume contributed 13.7 (mt) and increased +7% YoY while export sales volume contributed 0.1 mt or decreased -30% YoY.

- We expect an improvement for sales volume in the last quarter of 2018 from a pickup in infrastructure development.

Valuation: Maintain SELL with TP 16,000

- Using a DCF valuation with WACC at 11%, we are targeting INTP

- to trade at 48x 2018F PE within a year.

- Target Price is IDR 16,000 which represents -7.8% downside. SELL.

Previously