BWPT

Contact our analyst Revita

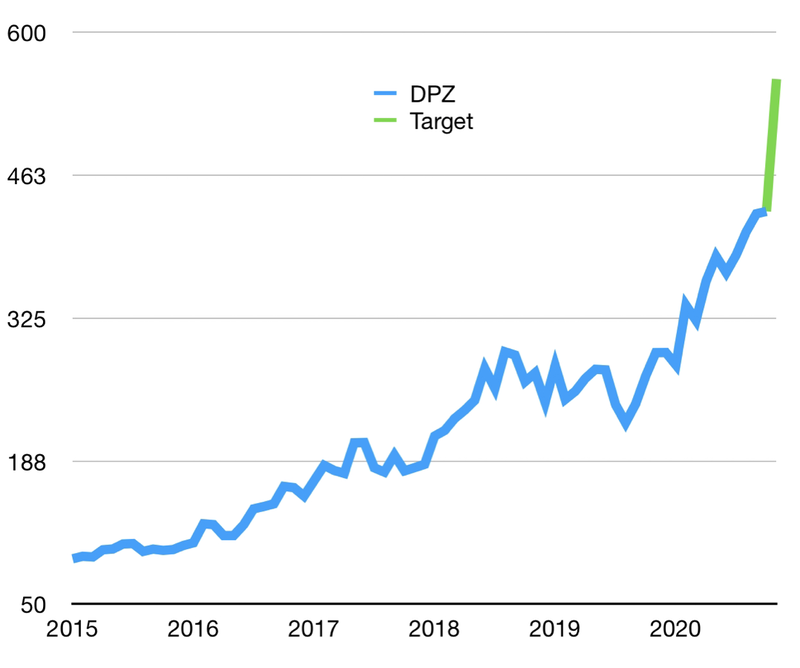

BUY with new target price, IDR. 500

Sept 13, 2018

Current price, Rp208

Target price, Rp500

Upside +140%

Current price, Rp208

Target price, Rp500

Upside +140%

Maintain productivity target

- We keep our BWPT production target as higher productivity is coming from both increased mature area and improved weather. Meanwhile cpo prices have been lower than we expected.

- August production reached a new all time high of 192,000 tons which is 3 times bigger than January’s production of 70,000 tons.

- We maintain our full year target of 1.57mn tons in 2018F and 1.80mn tons in 2019F. With a 13% lower CPO price prediction compared to our previous target, we adjust our top line revenue growth to 7% CAGR during 2018-2019F.

Don’t want the hassle of opening a trading account? We will do it all for you. You will be able to trade what you what, when you want, where you want. Sign up in seconds with phone or email 🔽

Expecting a return to profit

Valuation: Reiterate BUY, with high potential upside

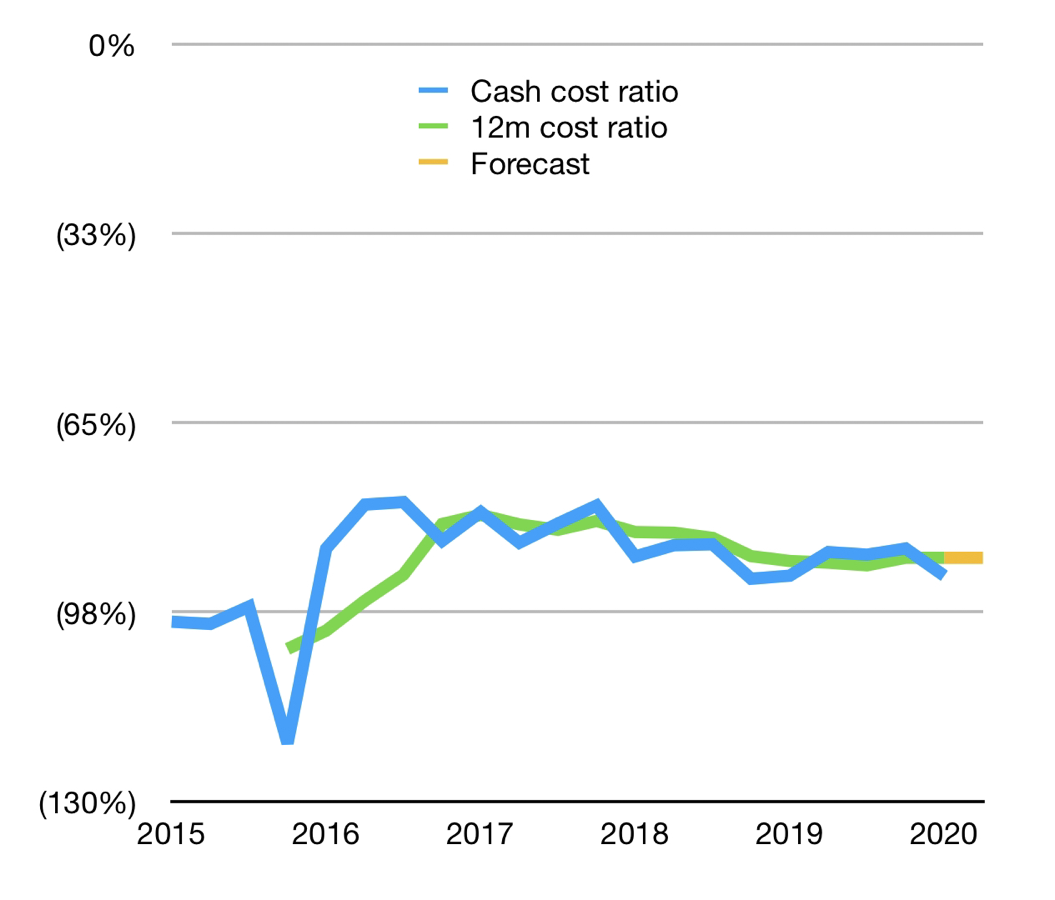

- We maintain our belief that bottom line profitability is coming back for BWPT.

- As shown during 1H18, BWPT managed to book net profit of IDR. 12bn as a fully mature plantation compared to a net loss of IDR. 98bn in 1H17 which showed that a return to profitability is indeed coming.

- Due to adjustments to our top line and based on 1H18 result, we adjust our target net profit for 2018F and 2019F to IDR. 34bn and IDR. 105bn respectively, supported by the maturing of the young plantations.

Valuation: Reiterate BUY, with high potential upside

- Based on our new targets we continue to believe that BWPT will move towards generating a profit starting from this year.

- We maintain our BUY recommendation, with a TP of IDR. 500/share, reflecting a valuation of 16x EV/EBITDA and offering significant potential upside of more than 100%.

Previously