BWPT

Contact our analyst Revita

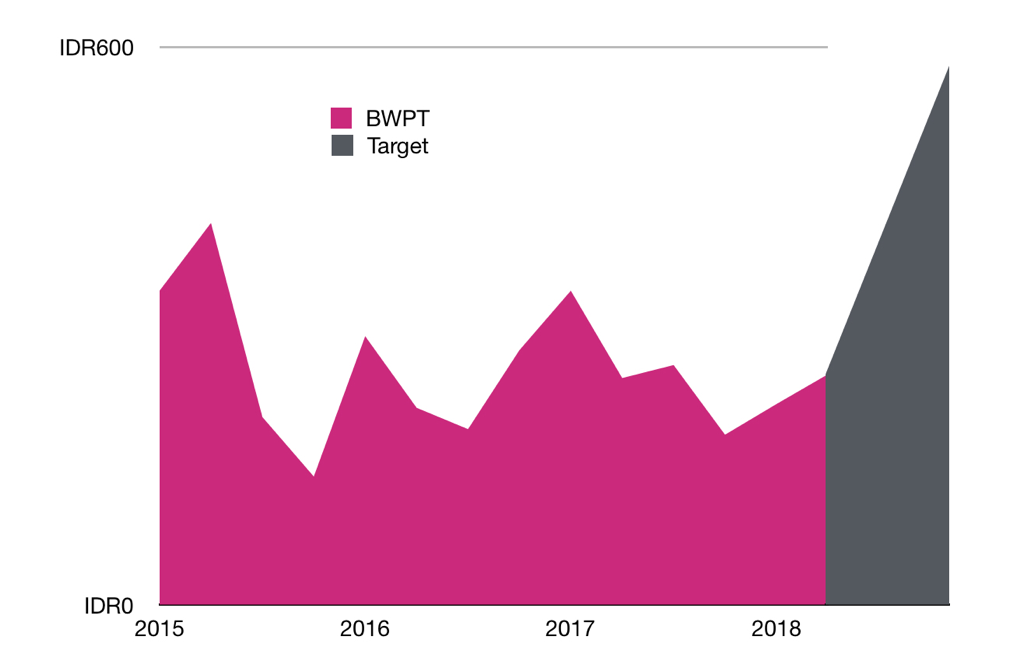

New Target Price IDR. 580

April23, 2018

Strong production growth

Back to profit in 2018

Valuation: Reiterate BUY, with higher potential upside

- We maintain our BWPT’s production target will remain on track for higher productivity from the increase in mature area and improved weather.

- In April we predicted that production will grow higher following the rainfall pattern that seems to be likely stronger than March.

- Based on 2017 production, we adjust our full year target to 1.57mn tons in 2018F and 1.80mn tons in 2019F.

- We expect a much better outlook for 2018 in production and prices.

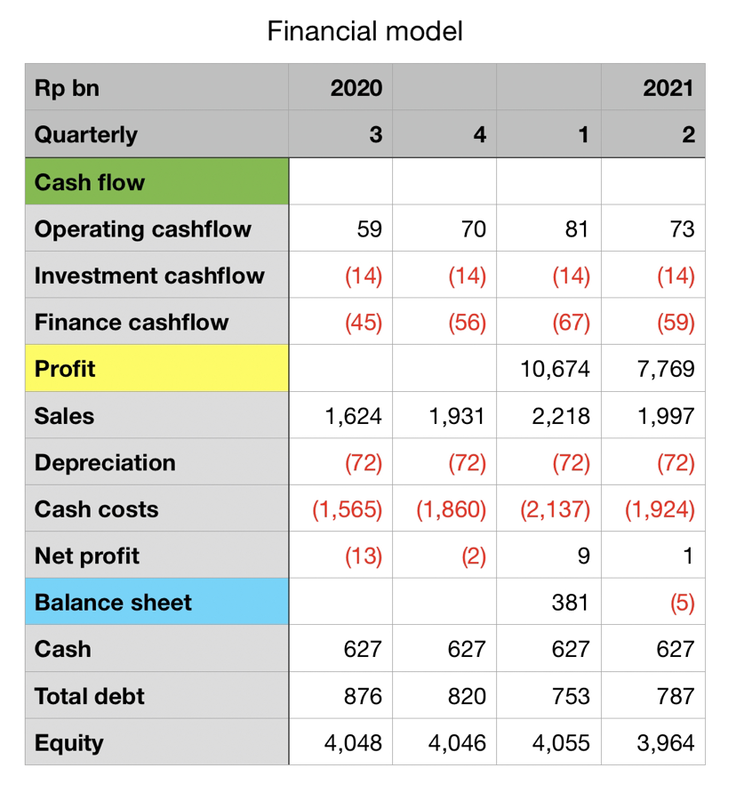

- We adjust our target for top line based on 2017 result, to 13% growth in CAGR during 2018-2019F.

Back to profit in 2018

- We maintain our belief that bottom line profitability is coming for BWPT.

- 4Q17, BWPT managed to book net profit to IDR. 23bn

- BWPT even has free cash flow positive and total debt starting to reduce in 2017FY.

- We adjust our target for 2018F and 2019F to net profit of IDR. 86bn and IDR. 190bn respectively, supported by the maturing of the young plantations.

Valuation: Reiterate BUY, with higher potential upside

- Based on our DCF (WACC 6.37%), we maintain our BUY recommendation, with a higher TP of IDR. 580/share, reflecting a valuation of 10.17x EV/EBITDA and significant potential upside.

- Since our latest update on Jan till now, shares price has increased more than 50% upside.

Previously