WTON

Contact our analyst Revita

54% upside

18th July 2018

Current price Rp 392

Target price Rp605

18th July 2018

Current price Rp 392

Target price Rp605

Strong Order Book

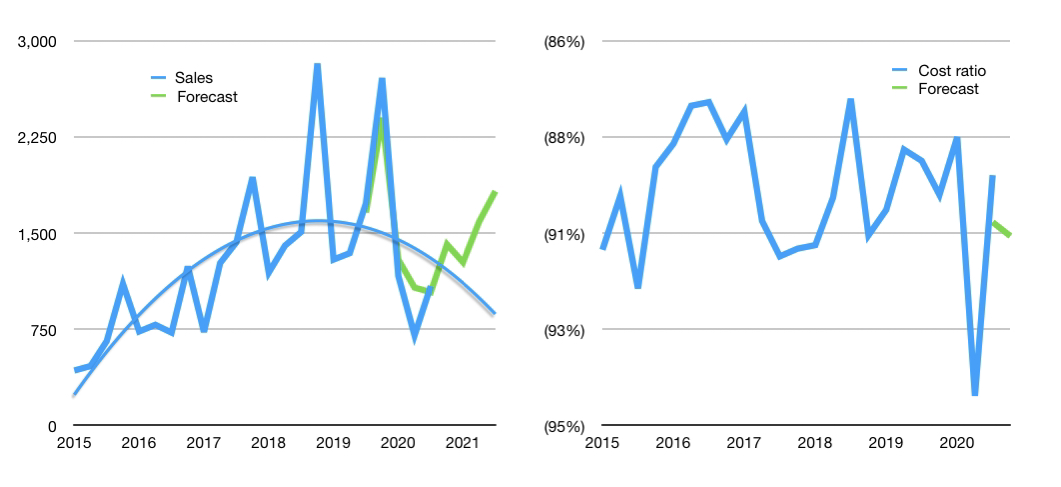

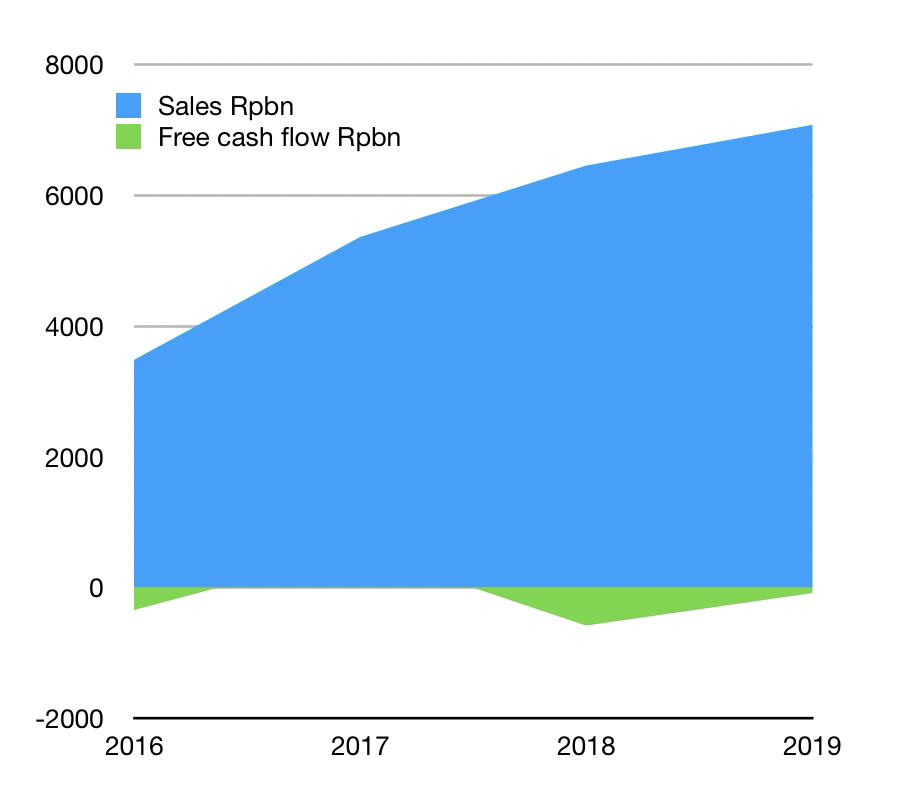

- 1H 2018, WTON booked new contracts of IDR. 3.13 trillion or 41% of the order book target for 2018.

- New contracts came mainly from outside WIKA group, while the WIKA group contributed 33%. 30% came from SOEs and 37% from private companies.

- In the future, following the historical trend for WTON, new contract volumes will be supported by the infrastructure sector and private-local customers.

- Based on 2017 results, we are updating our forecast total order book growth to 31% CAGR during 2017F-2018F.

- WTON’s plan to increase production capacity to 3.6 mn tons in 2018 is on track and as of May capacity has reached 3.4 mn tons compared to 3 mn tons in 2017A.

- New capacity comes from an additional line in South Sulawesi to support the Pettarani toll road project, which is now being developed by WIKA Beton in South Sulawesi.

- In addition, WTON continues to develop and innovate in precast products in order to be ahead of its peers. WTON is the only company using Inner Bore Technology in Indonesia, and is the only one developing floating dock precast for ports.

- With WACC 8.7%. we have a one year target price of IDR. 605/shares or trading at 12.3x PER, which gives 54% upside compared to the last price. BUY.

Previously

WTON