WSKT

Contact our analyst Revita

LOW, LOW PE, 52% upside

3 August 2018

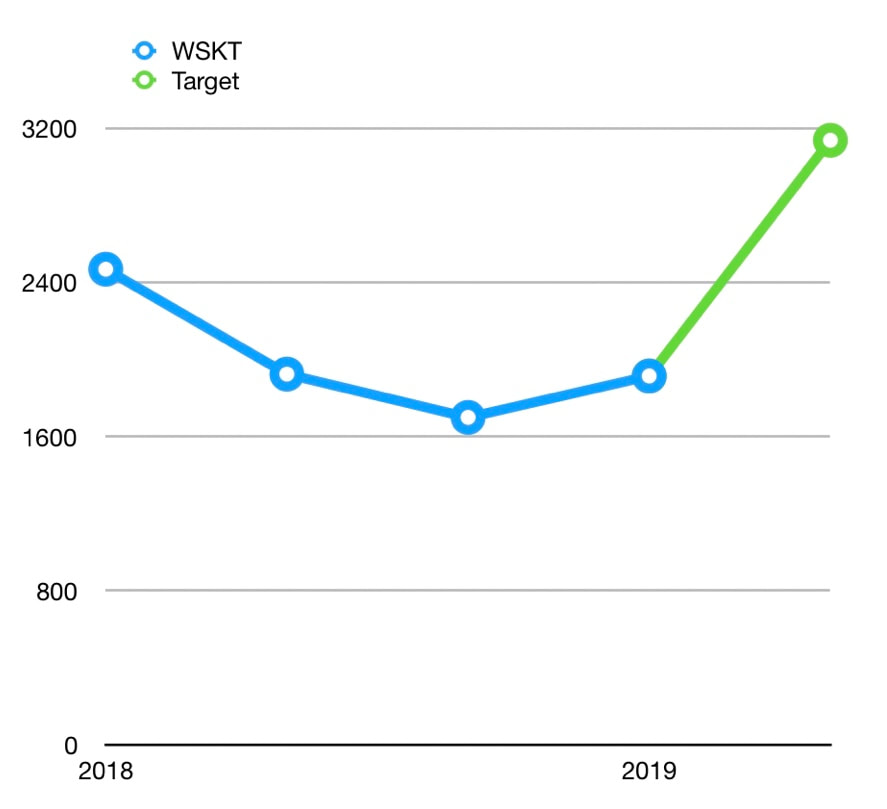

Current price Rp2070

Target price Rp3140

3 August 2018

Current price Rp2070

Target price Rp3140

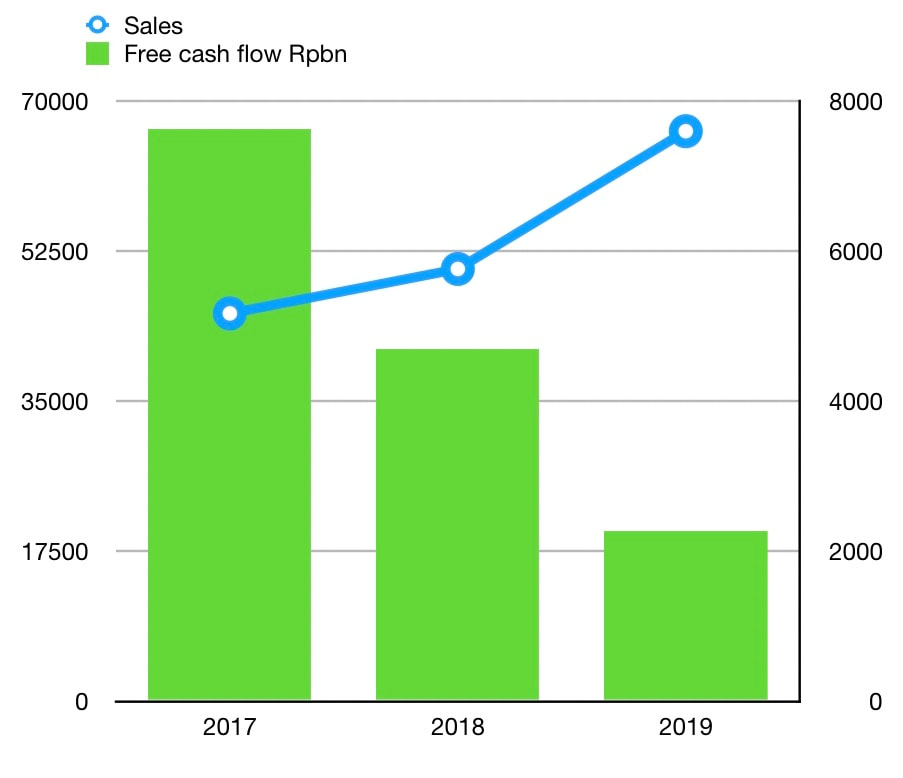

Stronger toll road business

Maintaining DER ratio

Valuation: 52% upside

- WSKT has new contracts of IDR. 7,65 trillion plus a high amount of carry over projects for this year, & a total order book as of 1H18 at IDR. 97 trillion. 87% of the new contracts come from pre cast and toll road projects.

- WSKT also has several other turnkey construction projects, such as LRT Palembang and electricity transmission will be completed in 2018. WSKT will receive cash from turnkey projects of about IDR. 20-30 trillion.

Maintaining DER ratio

- Despite many of the projects still requiring funding, we estimate by issuing bonds and adding loans, WSKT interest bearing debt to equity ratio will be 1.98x in 2018F compared to 1,85x in 2017A, still below the 2x which is management policy.

Valuation: 52% upside

- We have a one year target share price for WSKT of IDR. 3140, which would put the stock on 5.48x PER & gives the shares 52% potential upside. Compared to other peers, WSKT has the lowest PE ratio. We recommend BUY

Previously