WEGE

Contact our analyst Revita

40% upside.

13th March 2019

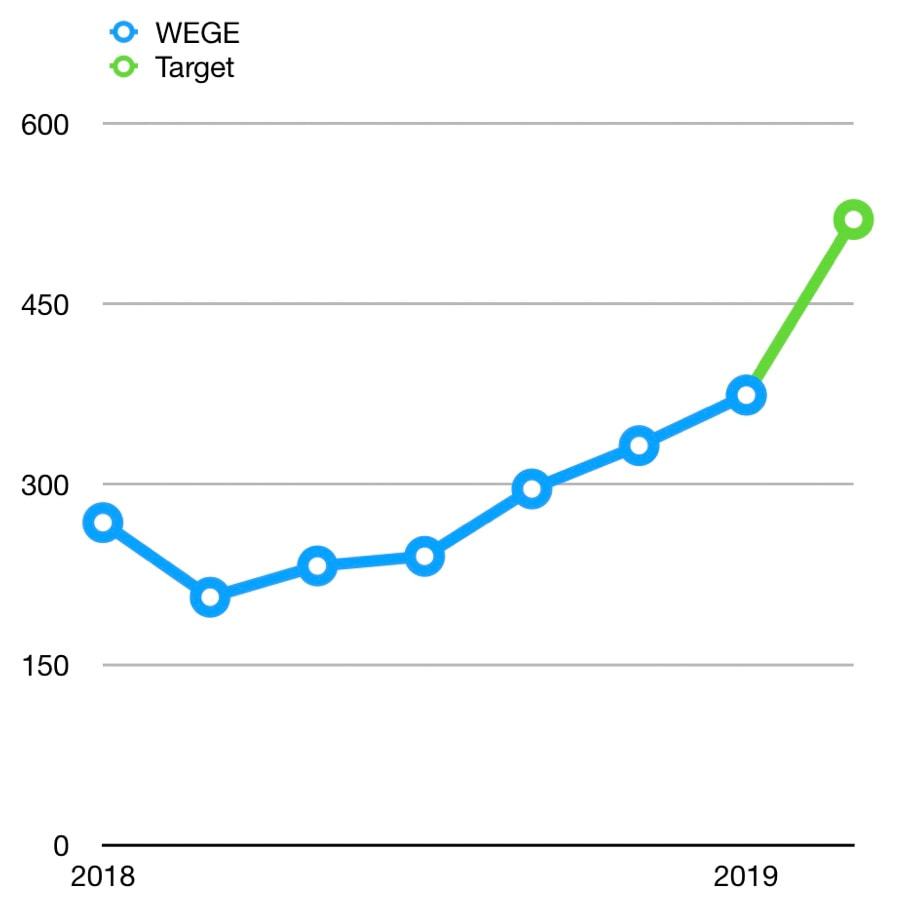

Current price Rp372

Target price Rp520

Current price Rp372

Target price Rp520

Heading to higher profit

On track for investments and concessions

Valuation: 40% upside

- As of 2018FY, WEGE managed to book revenue and bottom line growth of 50% yoy which is inline with our target. For this year, WEGE is continuing their goal to achieve more profit from an increase in new contracts targeted at 45% yoy which means a total order book of 22,78 trillion or 39% yoy growth compared to 27% yoy growth in 2018FY. Based on project owner in 2019F, most new contracts will come from Government 36%, with private 33%, and SOEs 31%.

- The burn rate target for this year remains above 30% as government projects are based on monthly progress. In terms of project type, most new contracts will still come from building construction followed by concession developments where residential is targeted to contribute 35%, public facilities 30%, offices 24%, and commercial 12%.

- After higher profits in 2017-2018 due to the DBG (Wika group ) merger into WEGE, we estimate 2019F bottom line growth will continue to be double digit at 38% yoy.

On track for investments and concessions

- In 2019, WEGE is targeting capex of IDR. 1,128 trillion

- After the 1st concession project, De Braga Hotel (Bandung), WEGE will get a 2nd concession project in Mandiri Proklamasi with a target to book revenue in 2020. WEGE is also targeting an airport concession.

- WEGE will receive revenue from the 1st concession in 2019F.

- We maintain our belief that a mix of projects from construction, investments and concessions will improve WEGE’s future profitability.

Valuation: 40% upside

- With business expansion as well as their entry into concession and investment projects, WEGE’s bottom line will improve in the future.

- We raise our TP within one year to 520 or 8.78 x PER. With 40 % upside, we maintain our recommendation to BUY.

Previously