TINS

Contact our analyst Revita

WATCH! Revita discuss her upgrade.

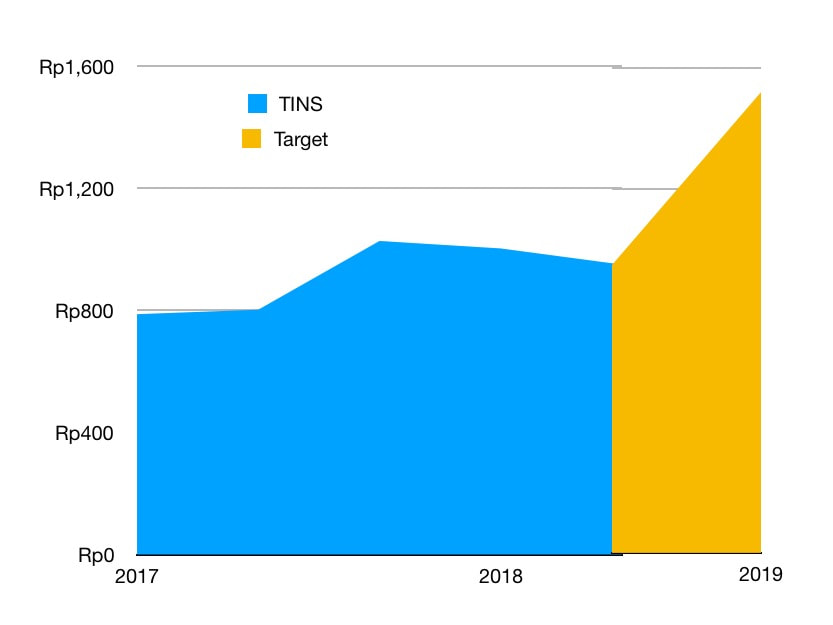

TP upgraded to Rp2,155 BUY

16th March 2019

Current price Rp1,345

Target price Rp2,155

16th March 2019

Current price Rp1,345

Target price Rp2,155

Higher production

Capex for exploration on progress

Valuation: 60% upside

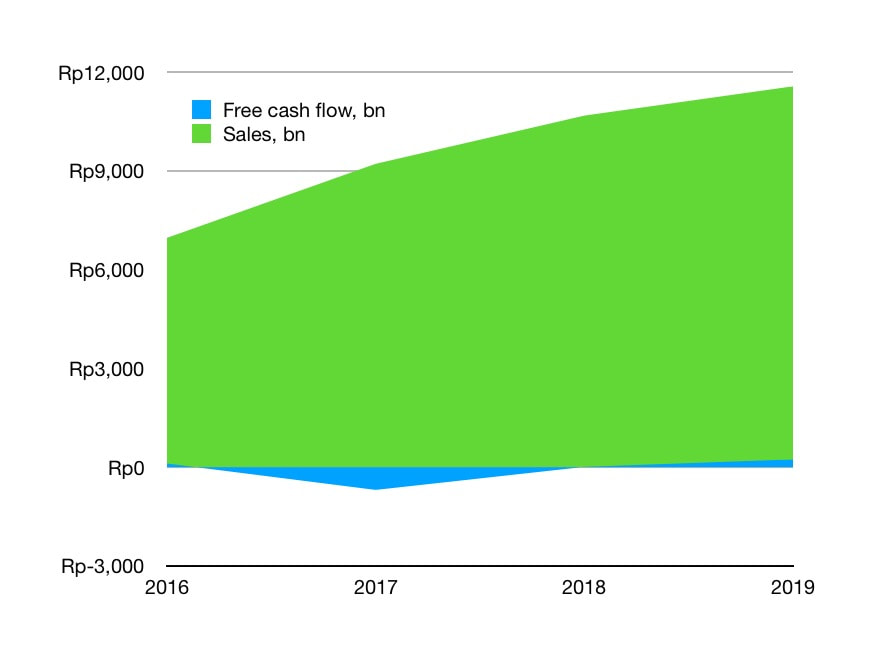

- We estimate a continued increase to 60000 tonnes compared to 44513 tonnes in 2018A.

- We expect favorable tin prices as supply is still limited while demand is still high.

- We believe regulatory support has helped drive TINS’ operational and earning performances higher last year, The new Indonesian Government regulation is that every tin mining business must report their mineral reserves and set out a budget work plan (RKAB).

- TINS is the only producer of tin which can fulfill the requirements so the company is 100% of tin exports in the first 3 months of 2019 compared to 98% in 2018FY.

- We estimate TINS bottom line growth during 2019-2020F to improve significantly compared to historically and to average 76% yoy from better production and sales volume.

Capex for exploration on progress

- TINS set aside capex for 2019 of IDR, 2,6 trillion with most of capex plans for maintenance and to enlarge capacity including Ausmelt. In addition, Capex will be used to explore for tin outisde Indonesia, in Africa and Myanmar.

- TINS will also start to develop mineral products associated with tin (mineral ikutan/Logam tanah jarang) in the future.

Valuation: 60% upside

- Based on PER. we have a target price for TINS within one year of IDR. 2,155/ share or trading at 9.8PER, which gives 60% upside from the current price (IDR.1345/share).

- We recommend to BUY.

Previously

| tins_19_march_2018.pdf |

| tins_18_january_2018.pdf |

| tins_7_december_2017.pdf |

| tins_9_october_2017_.pdf |