TINS

Contact our analyst Revita

WATCH! Revita discuss her upgrade.

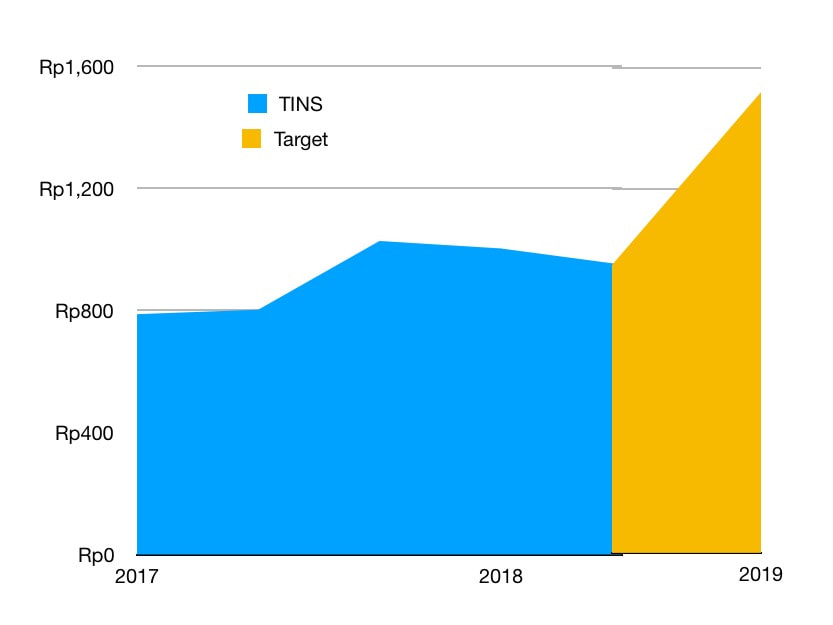

TP upgraded to Rp1,520

19th March 2018

Current price Rp1,020

Target price Rp1,520

19th March 2018

Current price Rp1,020

Target price Rp1,520

Production & price growth

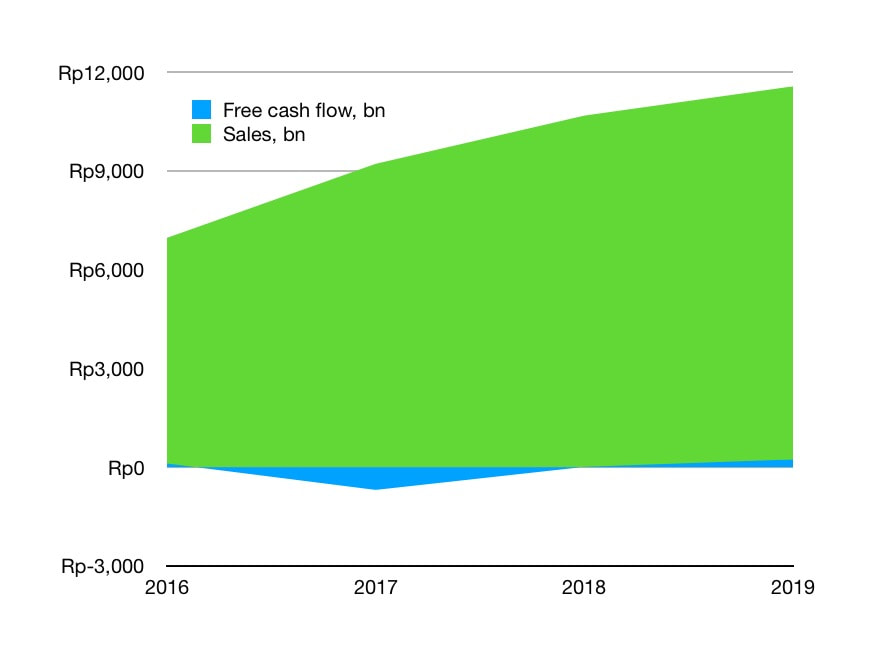

- As we said TINS’ plans to expand and grow production through adding two new processing technologies, expected to begin increasing production in 2H18. For 2018F, we estimate continued growth following 2017FY tin metal growth of 27% yoy.

- We expect favorable tin prices as supply is still limited while demand is still high. 2017FY, tin prices increased 11% yoy to 20249 USD/MT.

- Based on 2017FY results, we adjust our estimate for top line and bottom line, with bottom line targeted to grow by 77% CAGR 2018F aftee 2017A’s bottom line doubled from 2016A.

- As we said in our previous report, downstream sales from tin chemical and tin solder are growing.

- As of 2017, the production of Tin chemical and tin solder increased significantly by 174% yoy and 155%yoy.

- Based on PER. we have a target price for TINS within one year of IDR.1520/ share or trading at 14.44PER, which gives 49% upside from current price (IDR.1020/share).

- We recommend to BUY.

Previously

| tins_18_january_2018.pdf |

| tins_7_december_2017.pdf |

| tins_9_october_2017_.pdf |