GMFI

Contact our analyst Revita

Targeting 43% upside. BUY

28th November 2018

Price Rp 210

Target price Rp 300

28th November 2018

Price Rp 210

Target price Rp 300

Focus on expansion

- GMFI is focusing on organic expansion into component and engine maintenance (Repair and overhaul) as demand growth is strong and will outstrip line maintenance

- GMFI plans to capture engine MRO market share and reduce dependence on their line maintenance work for affiliate Garuda Indonesia (GIAA)

- GMFI has been continuously adding non affiliated customers to diversify its revenue.

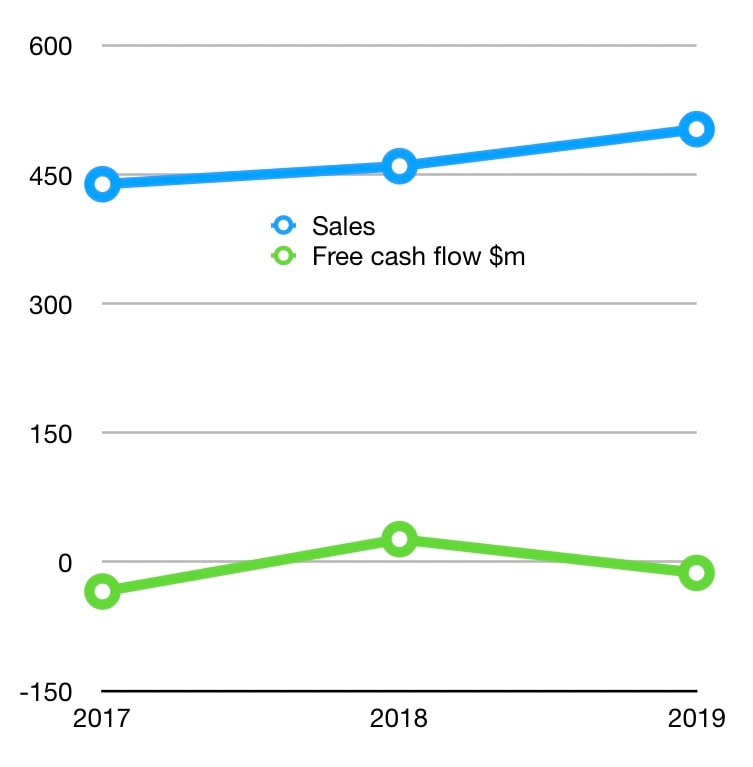

- As of 9M18, the line maintenance’s revenue went down 14% yoy following the lower GIAA air traffic growth.

- Repair and overhaul revenue increased 14% yoy.

Sign up now to trade; what you want, when you want, where you want.

Develop capacity, capability, and partnership

Valuation: 43% upside potential

- As of 3Q18, GMFI has signed a partnership with Air France Industries, KLM engineering & maintenance and PT China Communications Construction Indonesia.

- The new capabilities are to reduce dependence of sub-contractors in component and engine maintenance.

- This business segment has lower margins as shown by 9M18 result where OPM and NPM fell to 11% and 8% compared to 18% and 12% respectively in 9M17.

- In 2019F, we estimate GMFI’s margin will be lower compared to historically but we believe in the long term capability development will help GMFI margin to improve. We estimate OPM and NPM in 2019 will be 11% and 8% respectively.

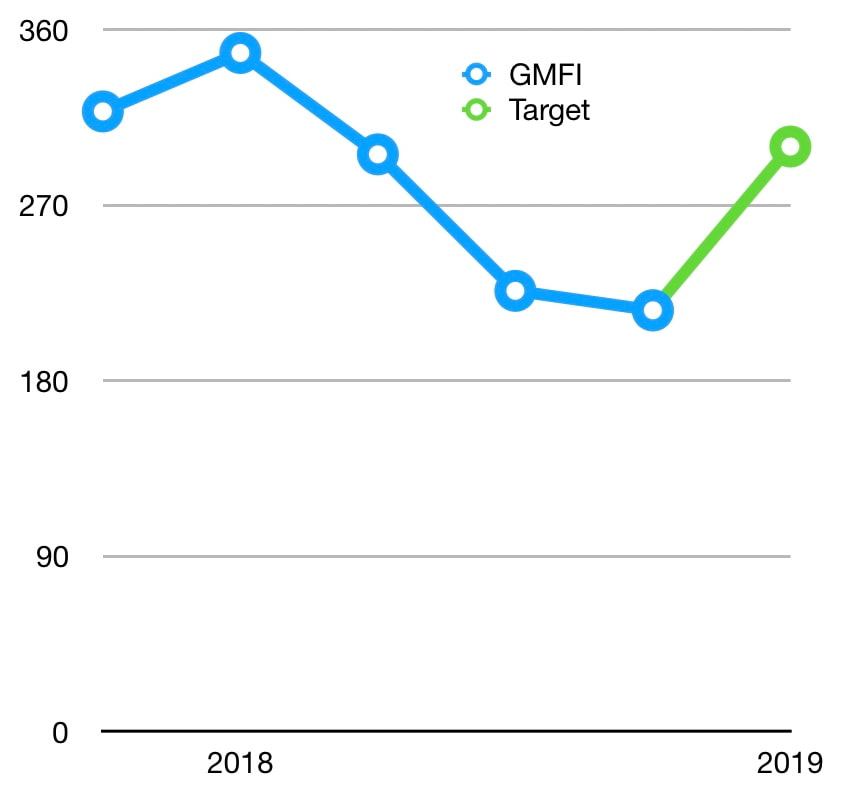

Valuation: 43% upside potential

- Based on DCF, with WACC at 7%, we are targeting TP within one year of IDR. 300/share which is 14,35x PER. With 43% upside potential, we recommend BUY.