ELSA

Contact our analyst Revita

Back on track, BUY

28th September 2018

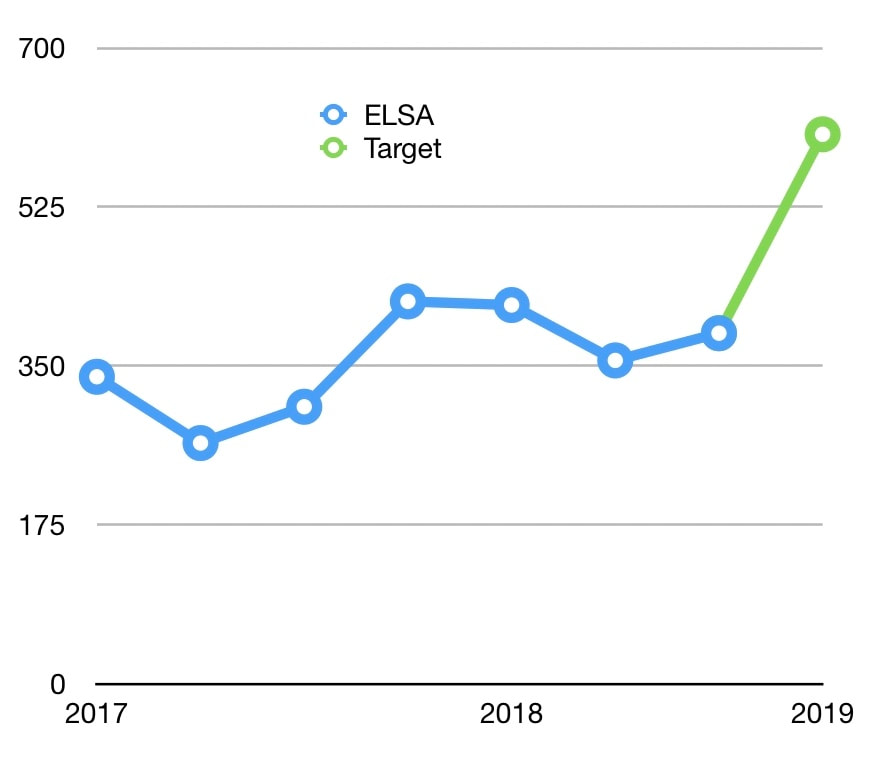

Current price Rp374

Target price Rp605

28th September 2018

Current price Rp374

Target price Rp605

Back on Track

Valuation: significant upside

- The slowdown due to expired blocks in Kalimantan which reduced DOS’ profitability, is over. In terms of upstream Assets (DOS), this year ELSA continues to work on blocks such as Mahakam, Sanga-sanga, ONWJ, Pertaminas’s blocks, and others.

- Most contracts are from Pertamina group (EP, PEP, PHM, PGE Pertamina Gas), Medco and Conoco.

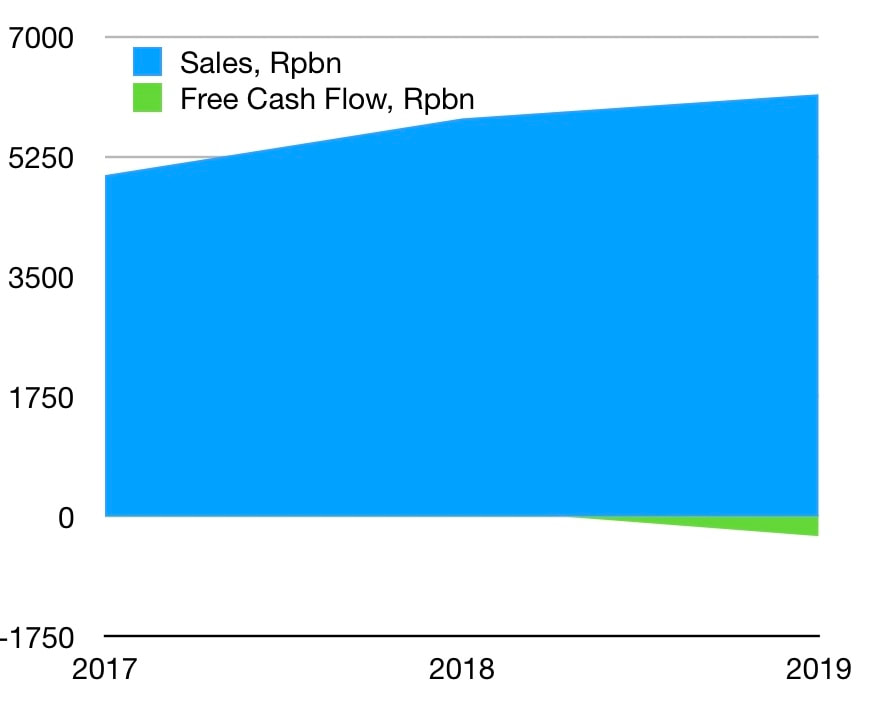

- During 1H18, Pertamina group contributed 66% to revenue while 34% is from 3rd parties. In marine seismic, work comes from projects in the Java sea, Singkawang, Selabangka, and soon in the Natuna sea. ELSA’s non asset based work (Operation maintenance services) is doing well in supporting DOS and downstream, logistic and distribution services are increasing their contributions to sales.

- We believe, ELSA’s focus in 2018 on increasing the contribution of non asset based downstream services will improve profitability, a lot.

- Based on 1H18, margins are improving such as GPM which grew to 10.4% from 8.1% in 1H17 while EBITDA margin climbed from 0.7% to 4.4% in 1H18 .

- The improvement in margins is inline with new contract from seismic, drilling, and operation maintenance that gives higher margins.

- We estimate GPM and EBITDA margin in 2018-2019 to average 14% and 15.77%.

Valuation: significant upside

- Based on DCF, with WACC 7.84% , we have a one year target price for ELSA of IDR. 605/share which puts the shares at 11.01x PER.

- With significant upside, our recommendation is BUY.

Previously