DOID

Contact our analyst Revita

Targeting 64% upside. BUY

8th November 2018

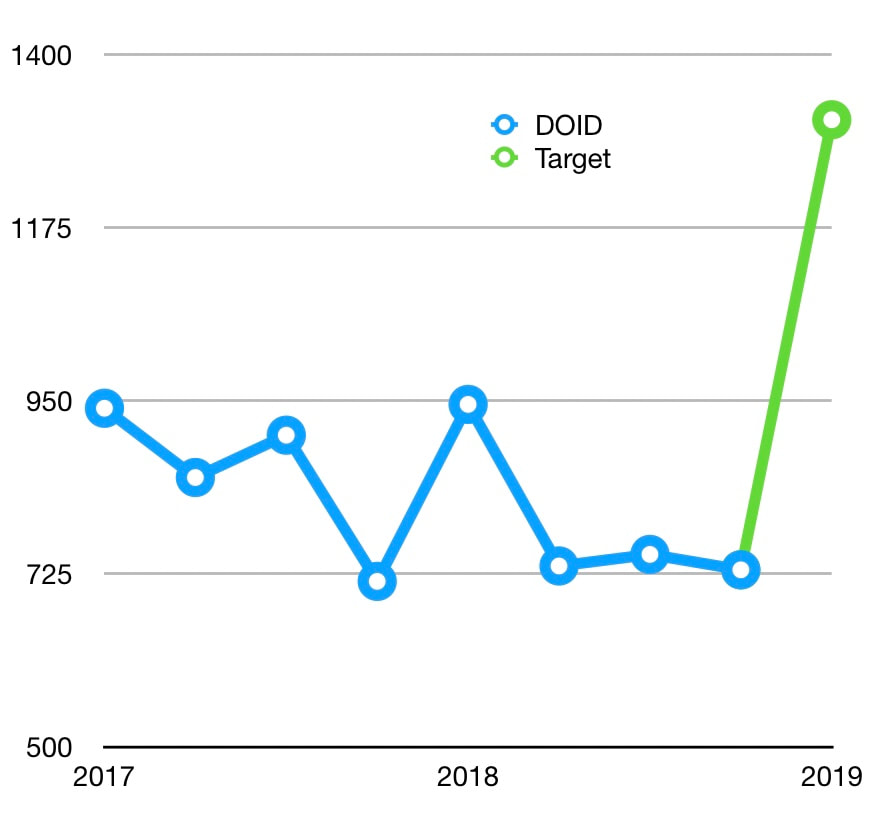

Price Rp 800

Target price Rp 1315

8th November 2018

Price Rp 800

Target price Rp 1315

Main issues resolved

- DOID improved profitability in 2H18 after a soft 1H18 due to weather disruptions and ramp-up challenges.

- Asset utilization and productivity improved through improvements in infrastructure and better management of the shift time of its workers in 1H18.

- These led to higher volume and lower production costs per unit in 3Q18. During 3Q18, cash costs ex fuel per bcm/km fell to 37 UScent compared to 44 UScent in 2Q18, and 43 UScent in 1Q18.

- Despite higher cost from additional new contracts as more equipment is deployed, DOID managed to book EBITDA up 29%yoy and 55% QoQ and the bottom line in 3Q18 increased 4x from 2Q18 and 39% yoy.

- Fuel cost expenses are not an issue as they’re mostly passed on to customers or reimbursed by customers such as Geo Energy and Bayan.

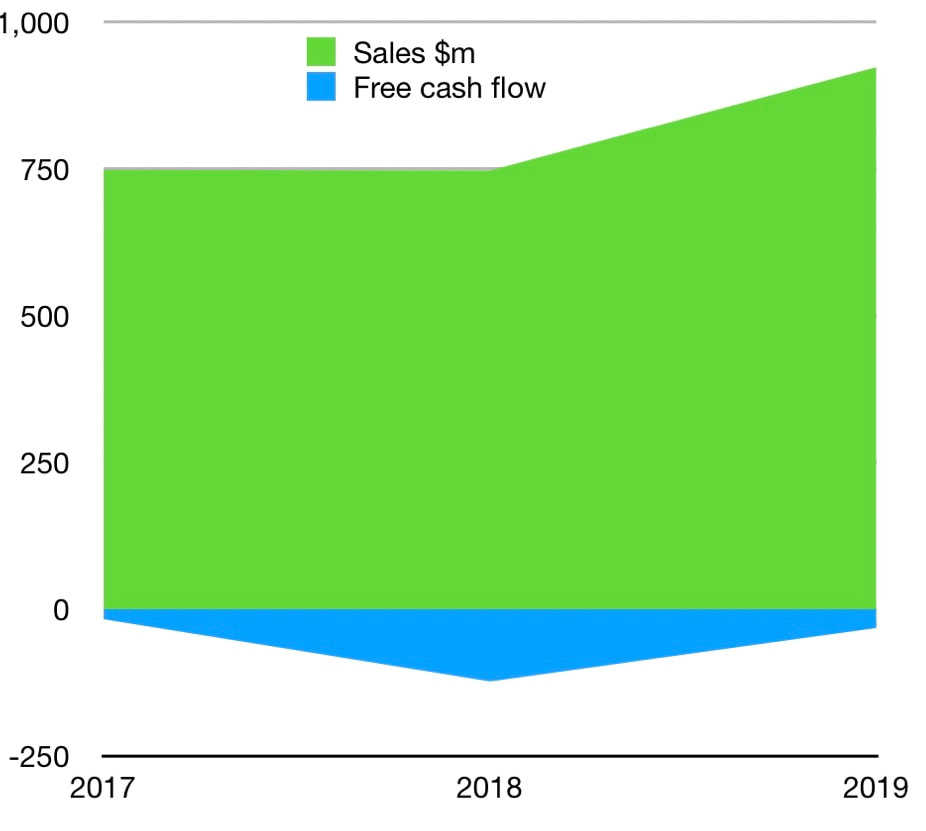

- Going forward, assuming no more ramp-up challenges, supportive weather and a coal price that we believe will still be above USD.80/ton, DOID is expected to continue delivering profitability in 4Q18 . We are targeting 2018F - 2019F earnings growth of CAGR (2017-2019) in EBITDA and bottom line growth of 17% and 31%.

Sign up now to trade; what you want, when you want, where you want.

Continuing double digit volume growth

Valuation: 64% upside. Reiterate BUY

- DOID has signed new contracts in April – May 2018 with PT Insani Baraperkasa (IBP), a subsidiary of PT Resource Alam Indonesia Tbk (RAIN) and PT Indonesia Pratama (IPR), a subsidiary of Bayan. The new contracts bring DOID’s total order book to US$. 7 billion.

- These two new contract and Lati (berau coal) which didn’t perform well in 1H18 will bring more volume in 2019F. We estimate volume growth will be double digit with OB volume of 2019F of 466mn BCM compared to 2018F of 398mn BCM. Historically, DOID’s volume grew on average above 10%.

- Going forward, we believe DOID efforts to pursue extensions and new contracts will bring long term sustainability and profitability. This is proven in 9M18, as DOID has 11 customers with most having long term contracts until 2025-2027.

Valuation: 64% upside. Reiterate BUY

- Weather is unpredictable, but with new contracts secured, improvements in asset utilization and an expected supportive coal price, we remain optimistic.

- Based on the 9M18 result, we are adjusting our earnings in 2018-2019F which translates to a one year target price of IDR. 1315/shares or 10.02x PER, lower than our previous IDR. 1540/share. We reiterate BUY.

Previously