BUMI

Contact our analyst Revita

89% upside. BUY

Targeting 9% production growth a year

Increase in Equity

Valuation: significant upside

- As of 1Q18, BUMI posted significant revenue growth of 2914% to USD. 310.5 mn in 1Q18

- Bottom line grew by 2.4% yoy to USD. 90,16 mn in 1Q18 based on accounting for joint venture agreements.

- In full consolidation, BUMI’s revenue grew 11%yoy while the bottom line grew18% yoy.

- We estimate CAGR revenue growth of BUMI during 2018-2019 will be 10% yoy fully consolidated with combined production estimated to average CAGR growth of 9% to reach 90.4mn tons and 99.4 mn tons in 2018F and 2019F compared to 2% CAGR growth in 2015-2017A

Increase in Equity

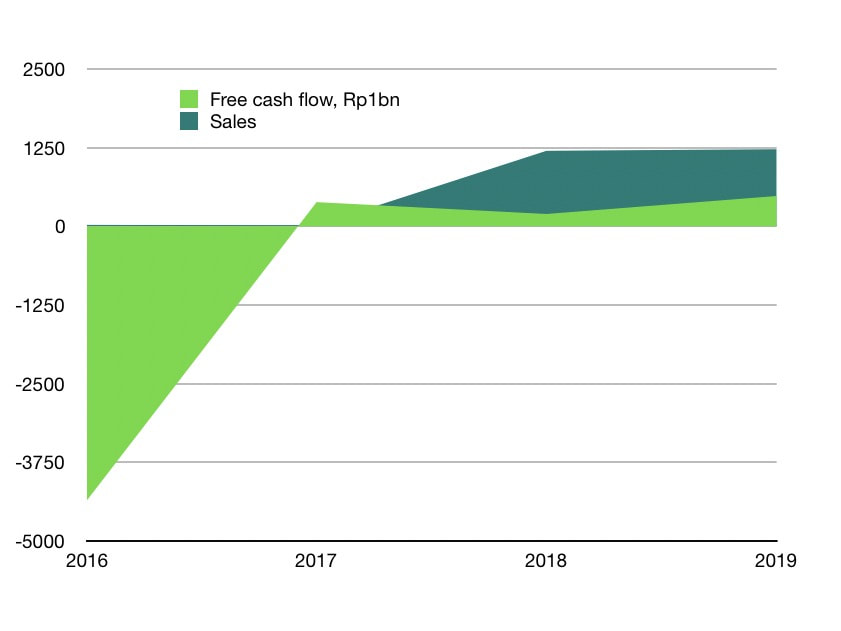

- Since BUMI’s debt restructuring process started last year, BUMI has reduced its debt from USD 4.4bn in 2016FY to USD. 1.6bn in 2017FY.

- BUMI’s equity started to improve with total capacity deficiency attributable to owners decreasing from 2016A to 2017A.

- We are targeting DER to reduce to average 1.35x within 2018-2019 with debt payments of USD 200-400mn USD per annum.

Valuation: significant upside

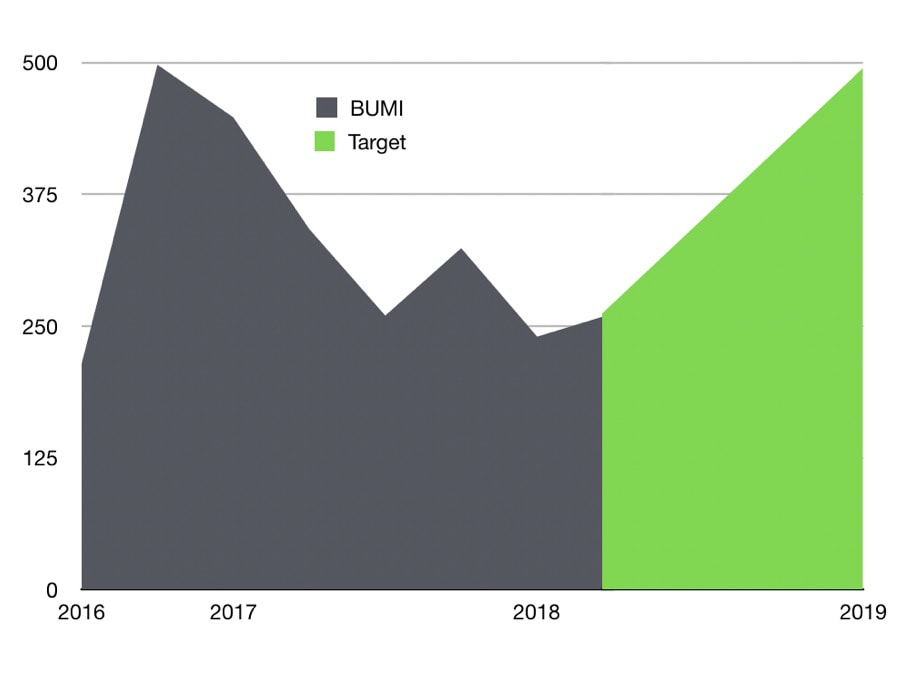

- We are targeting TP within one year of IDR. 495 which would equal 5x PER compared to currently 2x PER which is still undervalued.