ADRO

Contact our analyst Revita

Expanding again! 64% upside. BUY.

Growing, diversified production

Expanding

- 1Q18 coal production 8% lower yoy due to extreme weather condition.

- New blended coal product E4200 sales increased 42% yoy amid strong marketing efforts .

- ADRO targets coal production volume growth of 4 to 8% yoy for this year.

- We believe target is achievable as weather improves and from diversified products.

- ADRO has maintained sales to existing customers particularly premium ones in ASEAN with long term contracts.

Expanding

- ADRO is expanding inside & outside Indonesia.

- Binding agreement with Melbourne-based private equity firm EMR Capital to acquire Rio Tinto’s 80% stake in remaining coal mine in Australia for US$2.25 billion, to offset domestic government cap.

- Power projects from BPI & TPI will start to contribute to earnings 2019 onward, creating captive demand for coal.

Sign up now to trade; what you want, when you want, where you want.

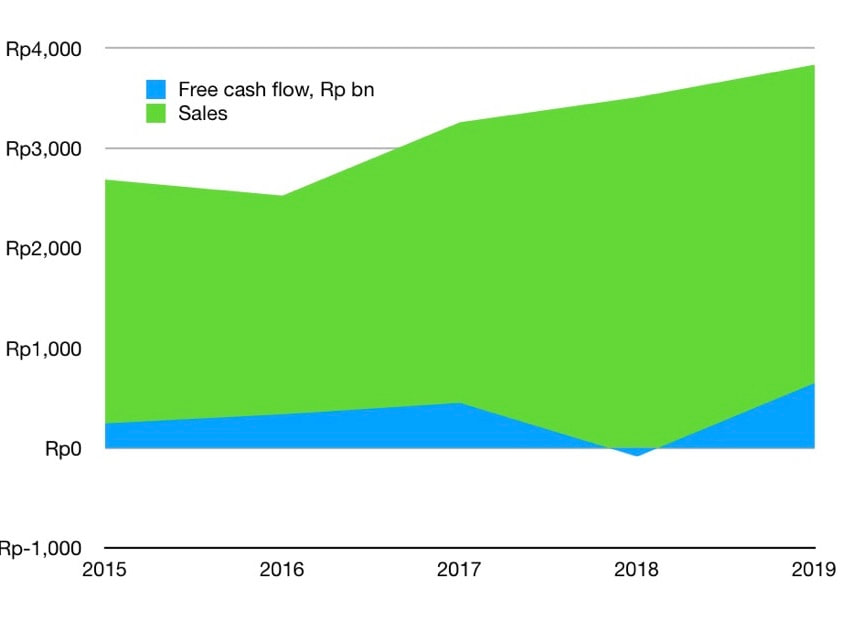

Margins maintained

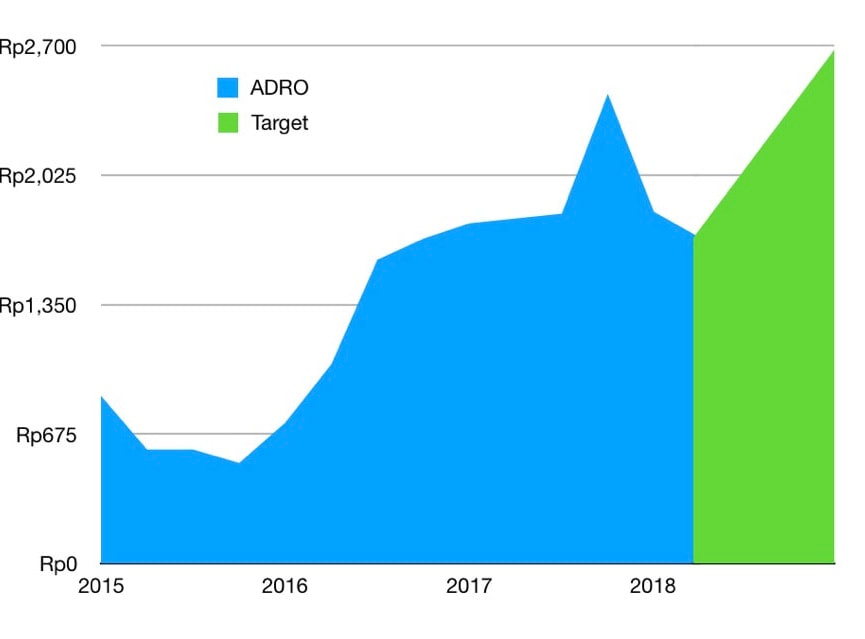

Valuation: 64 % upside potential

- Despite higher expenses during 1Q18 due to strip ratio, fuel cost, marketing expenses, EBITDA margin maintained at 36% on cost discipline.

- Strong liquidity of cash & available-for-sale financial assets in 1Q18. During 1Q18, ADRO reduced bank loans by 9% yoy through US$ 101 mn of debt repayment.

- ADRO also hedged 20% of fuel requirements for 2018 at below budget.

Valuation: 64 % upside potential

- We target the price of ADRO within 1 year to reach 2680 or trade at 9.35x PER.