GIAA

Contact our analyst Revita

Targeting 38% upside. BUY

23nd May 2019

Price Rp 412

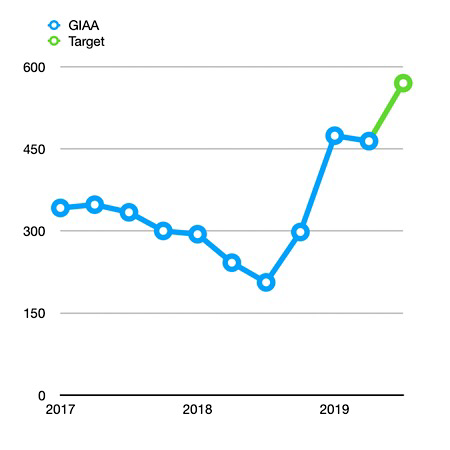

Target price Rp 570

23nd May 2019

Price Rp 412

Target price Rp 570

Focus on Margin

- After GIAA began their cooperation with Sriwijaya Group last year, the company is optimistic they can improve both GIAA and Sriwijaya group performances.

- As of 1Q19, GIAA’s domestic passenger yields grew 39.7%yoy while Citilink was up by 55.6%, Sriwijaya 149.5% and Nam Air 97.8%.

- Overall domestic passenger yields in 1Q19 increased 20.4% yoy to 7.6 USCent with a full year target of 7.74 USCent.

Sign up now to trade; what you want, when you want, where you want.

Improvement in profits

Valuation: 38% upside

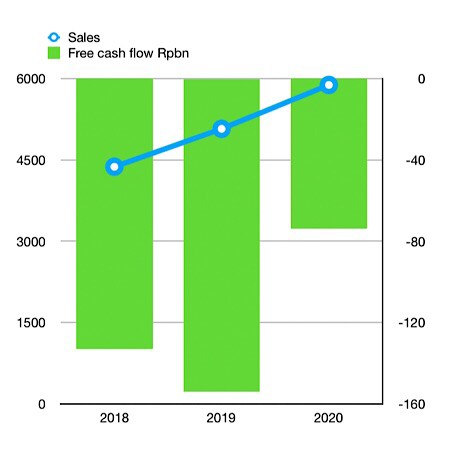

- During 1Q19, amid rising fuel prices and ticket prices, GIAA has improved its profitability by increasing the top line by 19.7% yoy and the bottom line by 130.7% yoy.

- GIAA is also locking in fuel hedges at 69 USCent/L, this plus low season in 1Q19, led to a fuel cost decrease of 9.4% yoy.

- GIAA will also cut unprofitable routes.

- In addition the government has responded to public concern over soaring airline ticket prices since the end of last year by lowering the upper limit on fares by 15%. We believe, this will not have much impact as there was a large increase in late 2018 and additional baggage fees for low cost carriers.

- We estimate bottom line in 2019F -2020F to reach USD.69.1 mn and USD. 102 mn respectively

Valuation: 38% upside

- We are targeting a TP within one year of IDR. 570/share which is 10x PER. With 38% upside potential, we recommend BUY.

Previously